Improving your credit score is a crucial step towards achieving financial stability and accessing better credit opportunities. While traditional methods like paying bills on time and reducing debt are effective, there are advanced techniques that can expedite the process of boosting your credit score. In this comprehensive guide, we will explore these advanced strategies to help you achieve rapid credit score improvement.

Dispute Inaccurate Information on Your Credit Report

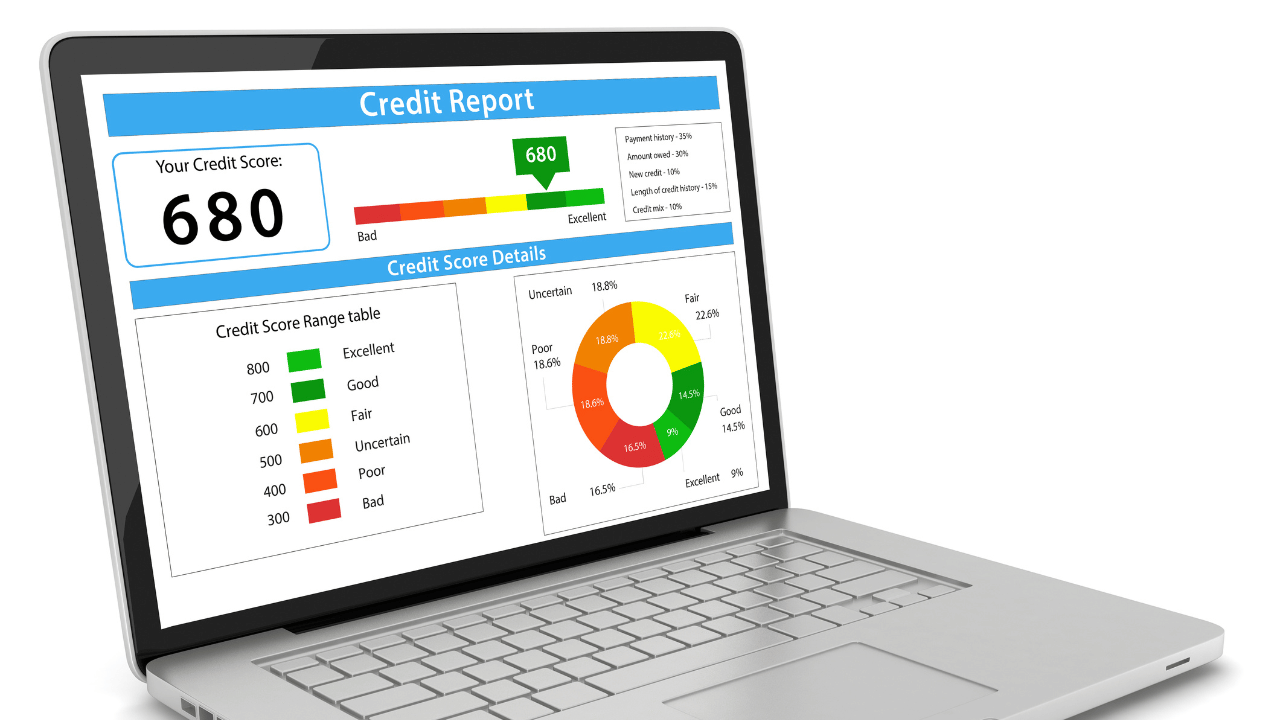

Review Your Credit Report Regularly

One of the fastest ways to improve your credit score is by ensuring the information on your credit report is accurate. Obtain a free copy of your credit report from the three major credit bureaus (Experian, Equifax, and TransUnion) and review it for errors.

Identify and Dispute Errors

Common errors that can negatively impact your credit score include incorrect personal information, duplicated accounts, and inaccurately reported late payments. If you find any discrepancies, file a dispute with the credit bureau to have them corrected. Accurate information will ensure your credit score reflects your true creditworthiness.

Pay Down High-Interest Debts Strategically

Use the Avalanche Method

The avalanche method involves paying off debts with the highest interest rates first while making minimum payments on other debts. This approach minimizes the amount of interest you pay over time and can lead to faster debt reduction, subsequently improving your credit score.

Consider Debt Consolidation

If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. This not only simplifies your payments but also reduces the overall interest burden, allowing you to pay off your debt more quickly and improve your credit score.

Increase Your Credit Limits

Request Higher Credit Limits

Contact your credit card issuers and request an increase in your credit limits. A higher credit limit can improve your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. A lower utilization ratio positively impacts your credit score.

Open New Credit Accounts

Another way to increase your total available credit is by opening new credit accounts. However, exercise caution and avoid opening too many accounts at once, as multiple hard inquiries can temporarily lower your credit score.

Become an Authorized User

Leverage the Credit of Trusted Individuals

If you have a family member or close friend with a good credit history, ask them to add you as an authorized user on their credit card account. As an authorized user, the account’s positive payment history will be reflected on your credit report, potentially boosting your credit score.

Use Credit Builder Loans

What Are Credit Builder Loans?

Credit builder loans are specifically designed to help individuals build or improve their credit. These loans work by holding the borrowed amount in a secured account while you make regular payments. Once the loan is paid off, you receive the funds, and your positive payment history is reported to the credit bureaus.

Benefits of Credit Builder Loans

These loans are particularly beneficial for individuals with limited or poor credit history. Regular, on-time payments on a credit builder loan can significantly improve your credit score over time.

Optimize Your Payment Strategy

Pay Bills More Than Once a Month

Instead of making a single monthly payment, consider paying your credit card bill multiple times throughout the month. This can help keep your credit utilization ratio low, as balances reported to the credit bureaus are often based on your statement date.

Set Up Automatic Payments

To avoid late payments, set up automatic payments for at least the minimum amount due. Timely payments are crucial for maintaining a good credit score, and automating this process ensures you never miss a due date.

Utilize Professional Credit Repair Services

Seek Expert Assistance

If you find it challenging to manage credit repair on your own, consider hiring a professional credit repair service. These services specialize in disputing inaccuracies on your credit report and negotiating with creditors to improve your credit profile.

Choosing the Right Service

When selecting a credit repair service, ensure they are reputable and have a track record of success. Read reviews, check for certifications, and be cautious of any service that promises guaranteed results, as credit repair is a complex and individualized process.

Diversify Your Credit Mix

Variety of Credit Accounts

Having a mix of credit accounts, such as credit cards, installment loans, and retail accounts, can positively impact your credit score. Lenders like to see that you can manage different types of credit responsibly.

Responsible Usage

While diversifying your credit mix, ensure that you manage all accounts responsibly by making timely payments and keeping balances low.

Negotiate with Creditors

Request Goodwill Adjustments

If you have a history of timely payments but have missed one or two due to exceptional circumstances, contact your creditors and request a goodwill adjustment. Creditors may agree to remove the negative mark from your credit report as a gesture of goodwill.

Settle Debts for Less Than Owed

In some cases, creditors may be willing to settle outstanding debts for less than the full amount owed. Negotiating a settlement can help you pay off debts more quickly, but be aware that settled debts may still impact your credit score, although less negatively than unpaid debts.

Conclusion

Improving your credit score rapidly requires a combination of strategic planning, disciplined financial management, and leveraging advanced techniques. By disputing inaccuracies, paying down high-interest debts, increasing your credit limits, becoming an authorized user, utilizing credit builder loans, optimizing your payment strategy, seeking professional help, diversifying your credit mix, and negotiating with creditors, you can significantly enhance your credit profile.