Credit Impact of Short Term Loans (Payday Loans)

Gain insights into the nature and mechanics of impact of short term loans, commonly known as payday loans. Explore how these loans work, their typical terms, and the target demographics they serve.

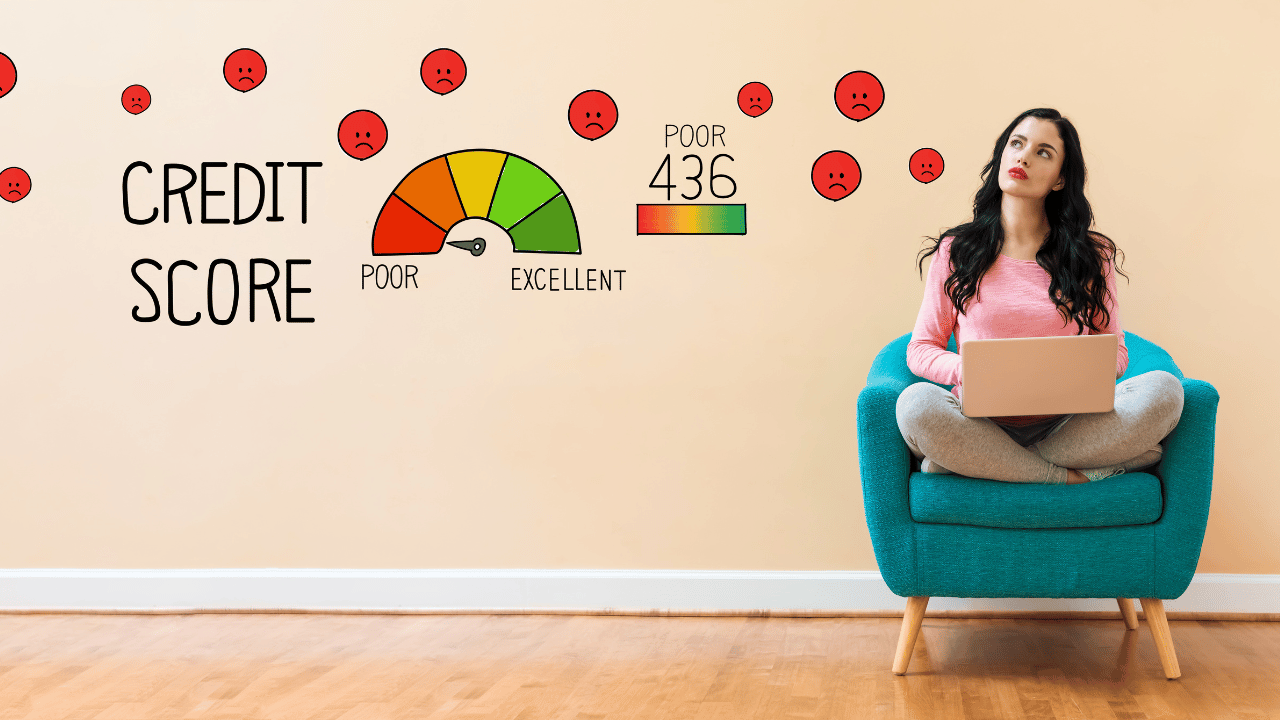

The Credit Impact :

Delve into the credit impact of taking out short term loans. Understand how these loans can affect your credit score and overall financial health, particularly if they are not repaid on time or in full.

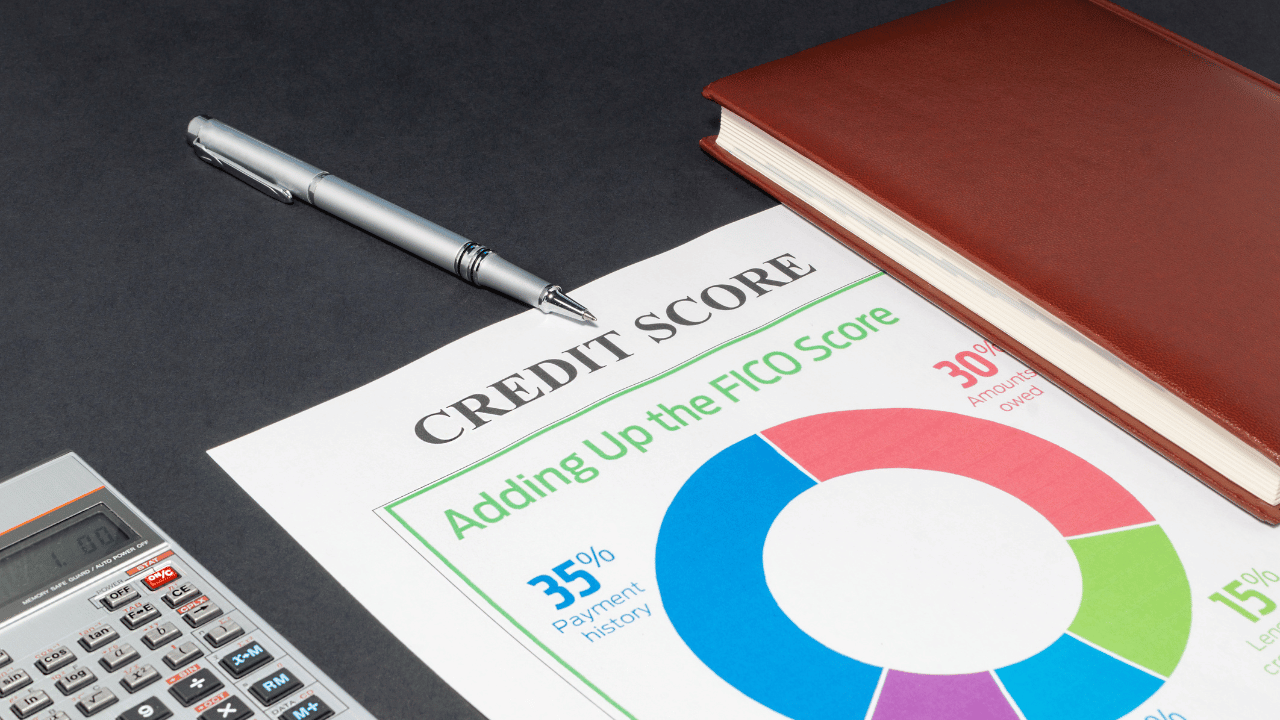

Credit Reporting Practices :

Learn about the credit reporting practices of payday lenders and how information about short term loans is typically reported to credit bureaus. Understand the implications for borrowers’ credit histories and scores.

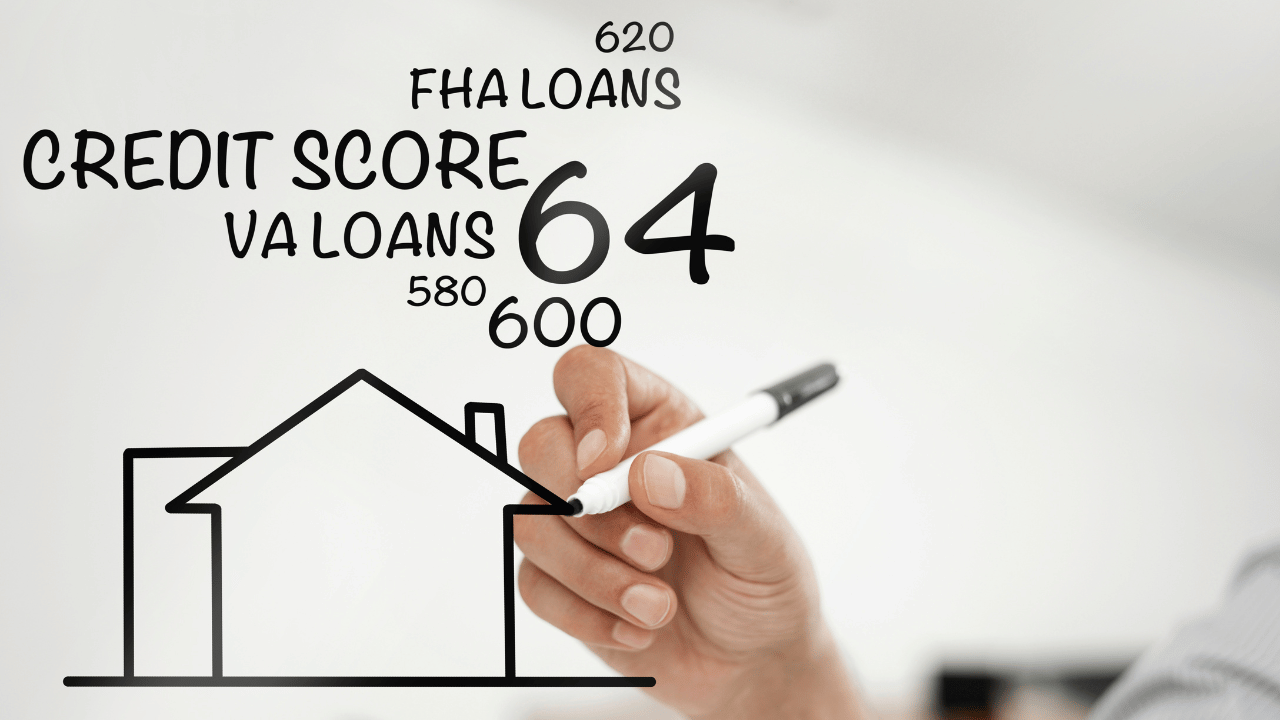

Alternatives to Payday Loans :

Explore alternative sources of short term financing that may have less of a negative impact on credit scores. Consider options such as personal loans from banks or credit unions, borrowing from friends or family, or using credit cards responsibly.

Managing Short Term Loan Debt :

Discover strategies for managing short term loan debt to minimize its impact on your credit. Learn about budgeting techniques, debt repayment plans, and financial counseling resources that can help you regain control of your finances.

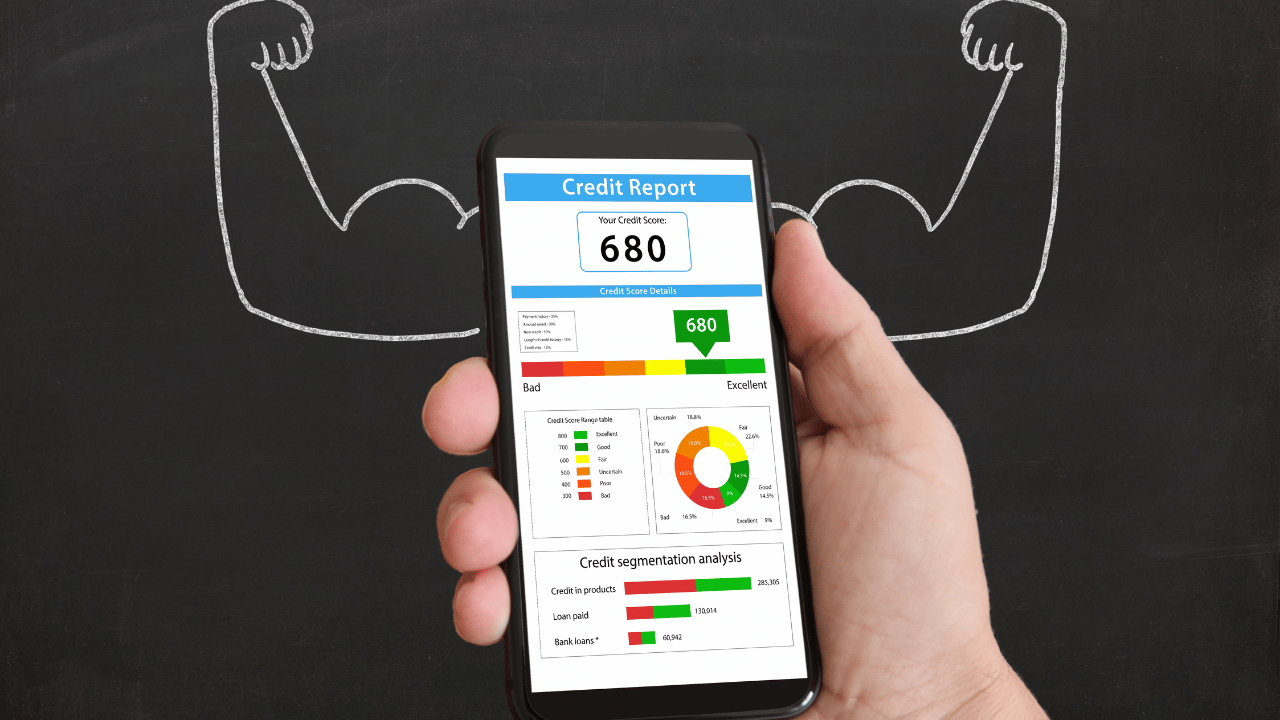

Credit Rebuilding After Short Term Loans :

Explore steps you can take to rebuild your credit after using short term loans. Understand how responsible borrowing and repayment behavior can gradually improve your credit score over time.

Avoiding the Cycle of Debt :

Learn how to break free from the cycle of debt associated with repeated use of short term loans. Explore strategies for building emergency savings, improving financial literacy, and seeking assistance from reputable credit counseling services.

Regulatory Considerations :

Understand the regulatory landscape surrounding payday lending and consumer protections in place to safeguard borrowers. Stay informed about relevant laws and regulations governing short term loans in your jurisdiction.

Conclusion :

Discover the credit impact of short term loans, commonly known as payday loans, and explore strategies for managing debt and rebuilding credit after borrowing. Understand alternative sources of short term financing and regulatory considerations in the payday lending industry.