Importance of Credit Reports in Credit Decisions

Explore the significance of explaining the importance of credit reports in making informed credit decisions. Understand how credit reports influence lending and leasing terms, and learn strategies to maintain a healthy credit profile.

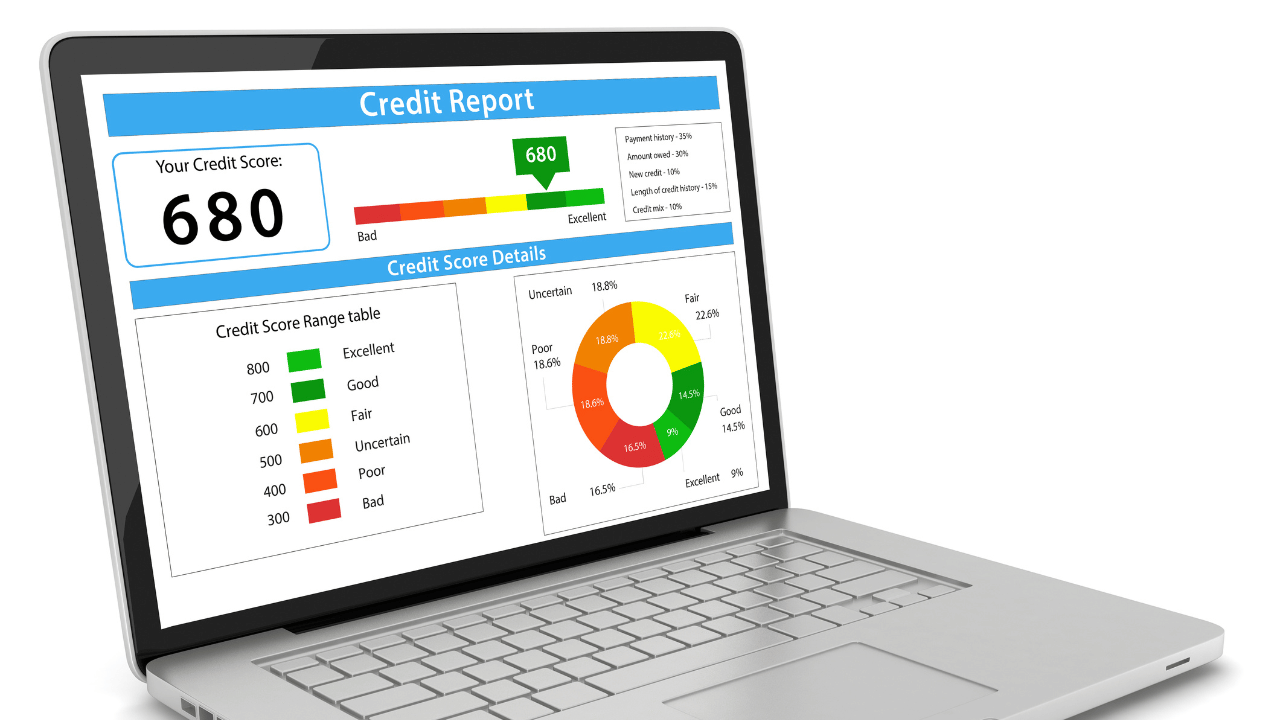

What is a Credit Report? :

A credit report is a detailed record of an individual’s or business’s credit history. Explaining the importance of credit reports helps in understanding their role in credit decisions.

Impact on Loan and Credit Approvals :

Credit reports are crucial in loan and credit card approvals. Lenders use these reports to assess creditworthiness, impacting approval chances and terms offered.

Influence on Interest Rates and Terms :

Credit reports significantly influence the interest rates and terms of loans and credit cards. A positive credit report can lead to lower interest rates and more favorable terms.

Assessing Credit Risk :

Lenders assess credit risk by analyzing credit reports.the importance of credit reports includes understanding how they reflect financial behavior and risk levels.

Benefits of Maintaining a Good Credit Score :

Maintaining a good credit report provides several benefits, including easier access to credit, better interest rates, and favorable terms, which are essential for financial health.

Strategies to Improve Your Credit Score :

Improving your credit report involves making timely payments, reducing debt, and regularly checking your report for errors. These steps can enhance your credit profile and creditworthiness.

Regular Monitoring and Updates :

Regularly monitoring and updating your credit report ensures accuracy and helps identify areas for improvement. It also helps in spotting potential fraud or identity theft early.

The Role of Credit Reports in Financial Decisions :

Summarize the key points about explaining the importance of credit reports. Emphasize their role in credit decisions and the importance of maintaining a healthy credit profile for better financial opportunities.

Conclusion :

By explaining the importance of credit reports, individuals and businesses can better understand how to manage their credit, ensuring they are well-positioned for favorable credit decisions and financial growth.