Credit Impact of Bridging Loans

Explore the significant impact of bridging loans on credit in this insightful blog. Understand how these short-term financial solutions affect credit scores and the implications for borrowers.

Understanding Bridging Loans :

Learn about the basics of bridging loans, a type of short-term financing used to bridge the gap between two transactions. Discover why these loans are popular for real estate purchases and other immediate financial needs.

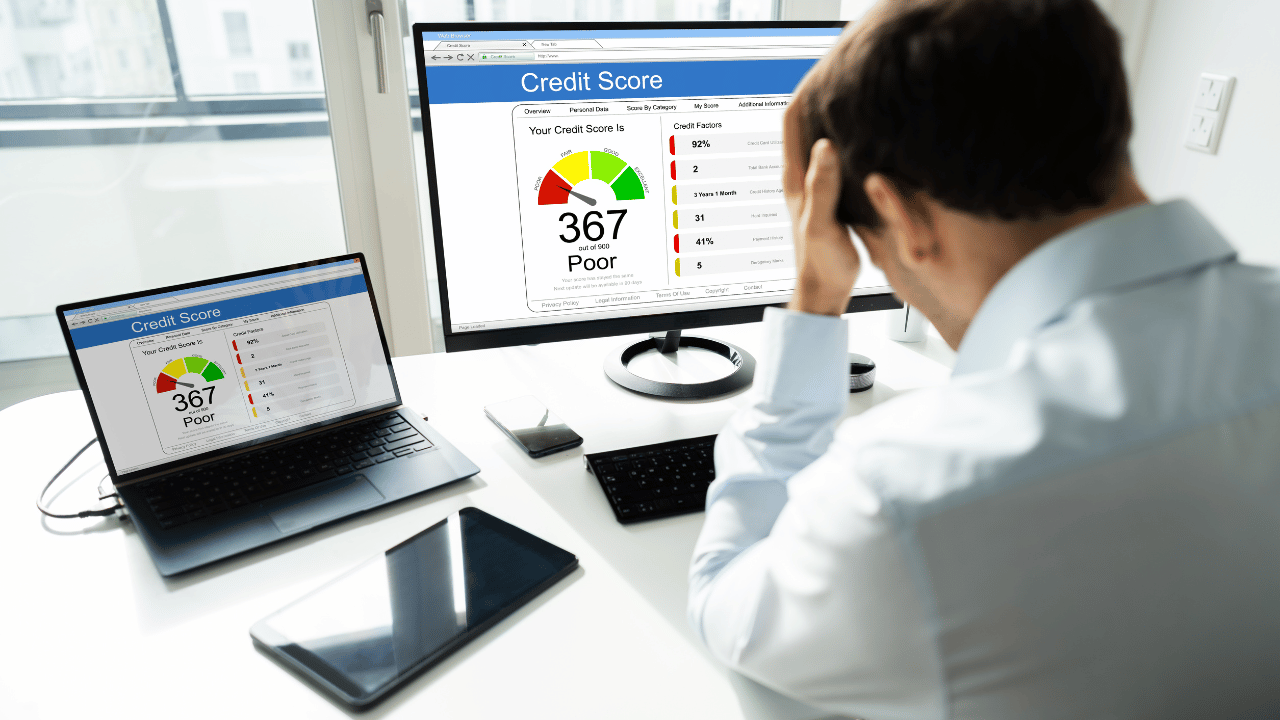

How Bridging Loans Affect Credit Scores :

Explore how the impact of bridging loans can influence credit scores. Understand the factors, such as the loan amount, repayment terms, and timeliness of payments, that can affect a borrower’s credit rating.

Short-Term vs. Long-Term Credit Implications :

Examine the short-term and long-term credit implications of taking out a bridging loan. While they can provide immediate financial relief, consider how they might impact your creditworthiness over time.

The Importance of Timely Repayments :

Understand the critical role of timely repayments in minimizing the negative bridging loans on your credit score. Late or missed payments can significantly harm your credit profile.

Balancing Multiple Loans :

Learn about the challenges and strategies for balancing multiple loans, including a bridging loan. Managing several financial obligations requires careful planning to avoid over-leverage and protect your credit rating.

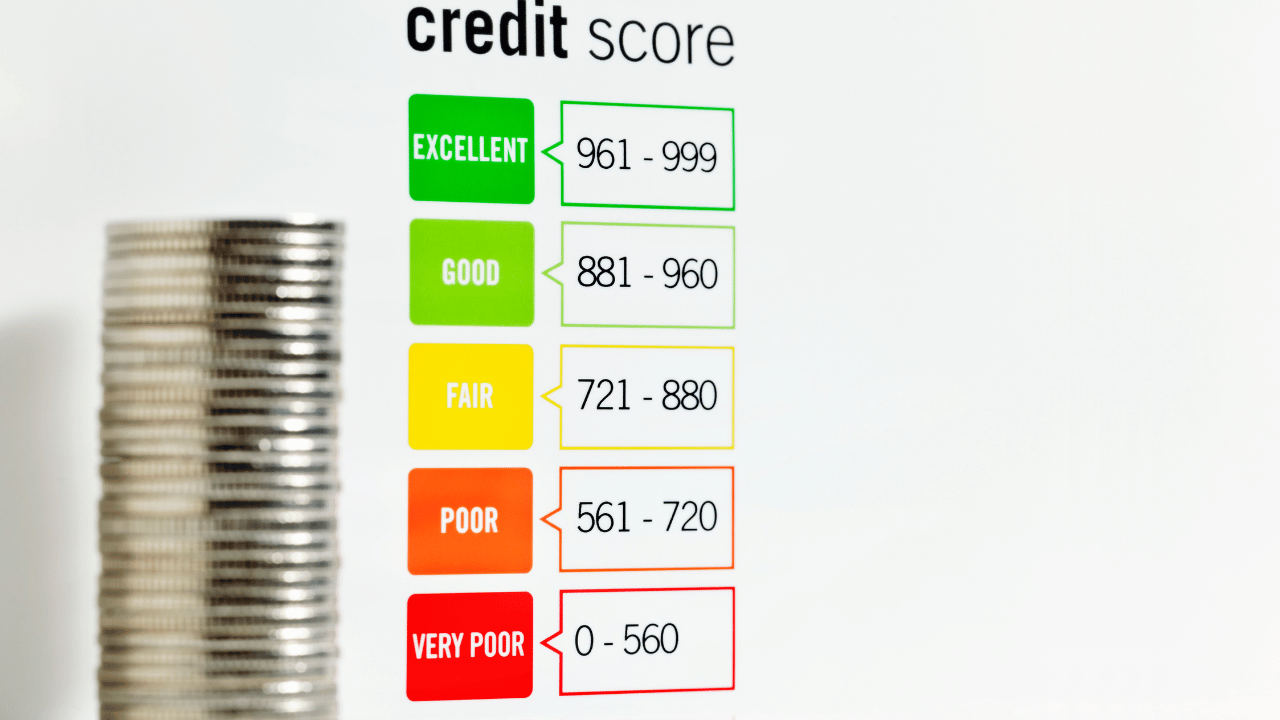

Credit Utilization and Bridging Loans :

Discover how bridging loans can affect your credit utilization ratio, an important factor in credit scoring. High credit utilization can negatively impact your credit score, so managing your total debt is crucial.

Alternative Financing Options :

Explore alternative financing options that might have a different credit impact compared to bridging loans. Understanding these alternatives can help you make more informed decisions about your financial strategy.

Conclusion :

Summarize the importance of understanding and managing the impact of bridging loans on credit. Encourage careful consideration and strategic planning to ensure these loans benefit your financial situation without harming your credit score.