Understanding the Role of Credit Scores in Forklift Leasing

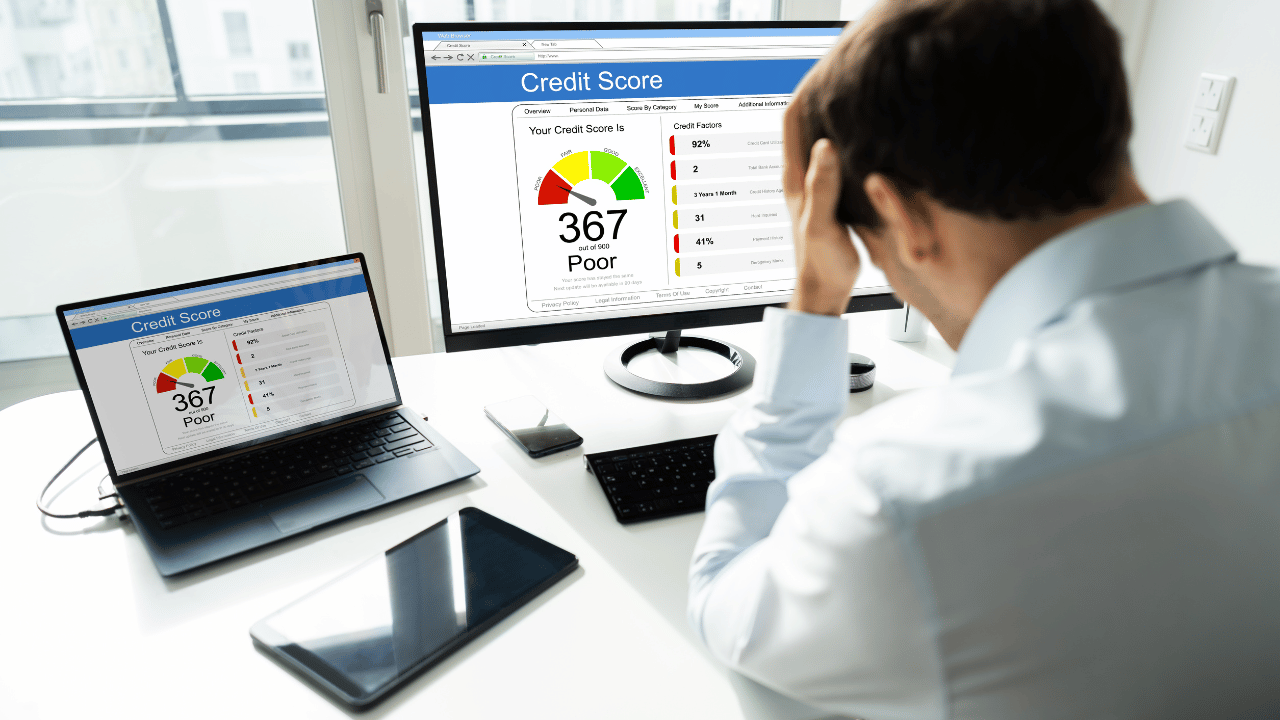

Explore the importance of credit score considerations for industrial equipment leasing in this insightful blog. Discover how creditworthiness impacts leasing decisions and shapes the dynamics of the industrial equipment leasing market.

The Role of Credit Scores in Industrial Equipment Leasing :

Understand the significance of credit score considerations in the industrial equipment leasing sector. Learn why creditworthiness is a crucial factor for lessors and lessees alike when negotiating lease terms and conditions.

Impact of Credit Scores on Lease Approval :

Examine how credit scores influence the approval process for industrial equipment leasing. Higher credit scores often lead to more favorable leasing terms, including lower interest rates, longer lease durations, and reduced security deposits.

Lease Terms and Conditions Based on Credit Scores :

Explore how credit scores impact the terms and conditions negotiated in industrial equipment leasing agreements. From lease duration to maintenance responsibilities, creditworthiness plays a significant role in determining the contractual terms.

Customization and Flexibility in Lease Agreements :

Understand how credit scores affect the level of customization and flexibility offered in lease agreements. Lessees with higher credit scores may have more negotiating power to tailor lease terms to their specific needs and requirements.

Risk Management and Credit Enhancement :

Discover strategies for lessors to manage risks associated with varying credit scores. From requiring security deposits to implementing credit enhancement mechanisms, lessors can safeguard their interests while accommodating lessees with diverse credit profiles.

Industry-specific Considerations :

Explore industry-specific factors that may influence credit score considerations in industrial equipment leasing. From market trends to regulatory requirements, understanding these factors is essential for making informed leasing decisions.

Future Trends in Credit Score Considerations :

Anticipate future trends in credit score considerations for industrial equipment leasing, such as the adoption of alternative credit scoring models and the integration of technology for risk assessment. Stay ahead of the curve to adapt to evolving industry dynamics effectively.

Conclusion :

This blog provides valuable insights into the significance of credit score considerations for industrial equipment leasing, empowering stakeholders to make informed decisions and optimize leasing arrangements for sustainable business growth.