various factors that influence credit considerations

When considering options for acquiring veterinary equipment, understanding the role of credit scores in veterinary equipment leasing is crucial. This blog explores the various factors that influence credit considerations when leasing equipment for veterinary practices, providing valuable insights for veterinarians and practice managers.

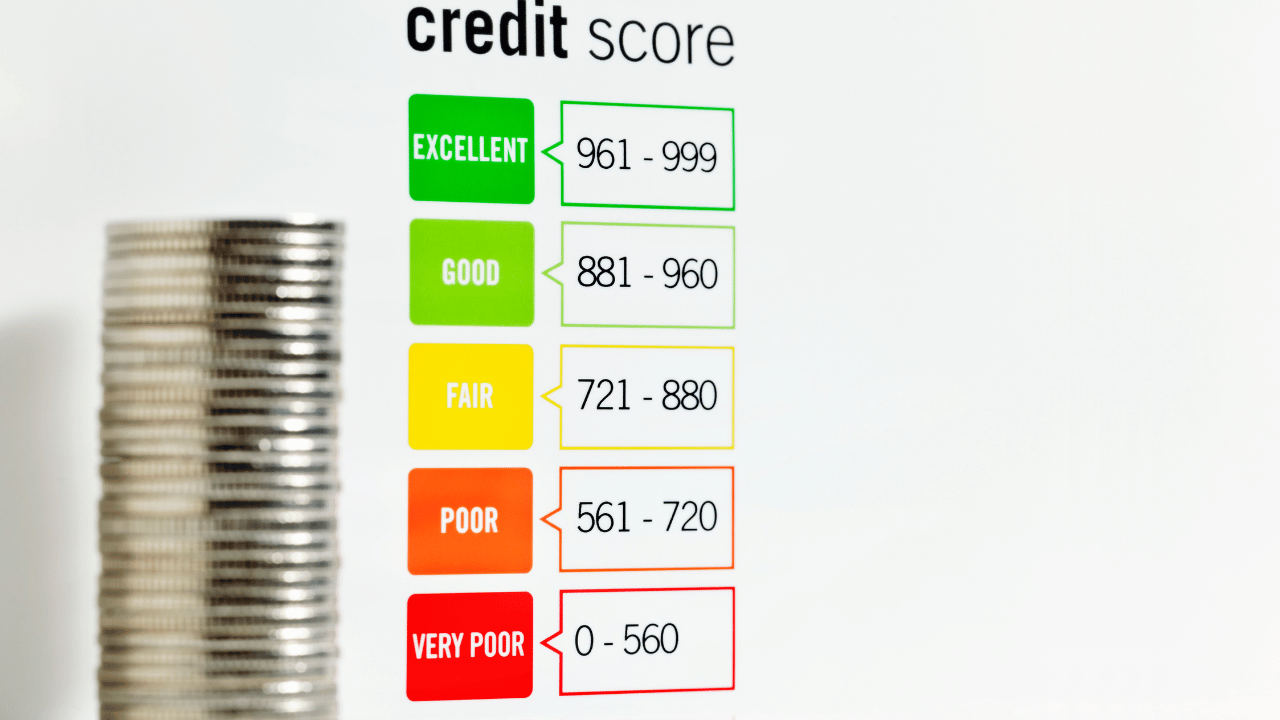

Importance of Credit Scores :

Credit scores play a significant role in determining the terms and conditions of equipment leasing agreements for veterinary practices. Lenders use credit scores to assess the financial risk associated with leasing veterinary equipment to ensure timely payments and minimize default risks.

Impact on Lease Approval :

A strong credit score increases the likelihood of lease approval for veterinary equipment, as it demonstrates the borrower’s creditworthiness and ability to fulfill lease obligations. Conversely, a lower credit score may result in higher interest rates or outright rejection of lease applications.

Factors Affecting Credit Scores :

Several factors influence credit scores, including payment history, credit utilization, length of credit history, new credit accounts, and types of credit used. Veterinary practitioners should maintain a positive payment history and keep credit utilization low to improve their credit scores.

Importance of Financial Stability :

Lenders also consider the financial stability of veterinary practices when evaluating lease applications. Factors such as steady revenue streams, positive cash flow, and profitability can offset lower credit scores and increase the likelihood of lease approval.

Options for Veterinarians with Lower Credit Scores :

Veterinarians with lower credit scores may still have leasing options available, albeit with higher interest rates or additional collateral requirements. Exploring alternative financing solutions or working with lenders specializing in equipment leasing for veterinary practices can provide viable options.

Lease Terms and Conditions :

Understanding the terms and conditions of veterinary equipment leases is essential for making informed decisions. Veterinarians should carefully review lease agreements, including lease duration, monthly payments, maintenance responsibilities, and end-of-lease options.

Building and Improving Credit Scores :

Veterinary practitioners can take proactive steps to build and improve their credit scores over time. This includes paying bills on time, reducing debt, monitoring credit reports regularly, and disputing any inaccuracies that may negatively impact credit scores.

Conclusion :

In conclusion, credit scores play a critical role in determining the feasibility and terms of veterinary equipment leasing. Veterinary practitioners should strive to maintain healthy credit scores to access favorable leasing options and secure essential equipment for their practices. By understanding the credit score considerations for veterinary equipment leasing, veterinarians can navigate the leasing process more effectively and make informed financial decisions for their practices.