Budget for Credit Card Payments

Embark on a financial empowerment journey with our guide on how to budget for credit card payments. From assessing your financial situation to creating a strategic repayment plan, discover the steps to ensure responsible credit card management.

Evaluating Your Financial Situation :

Initiate your budgeting process by evaluating your overall financial situation. Understand your income, expenses, and debt obligations to gain a comprehensive view of your ability to allocate funds for credit card payments.

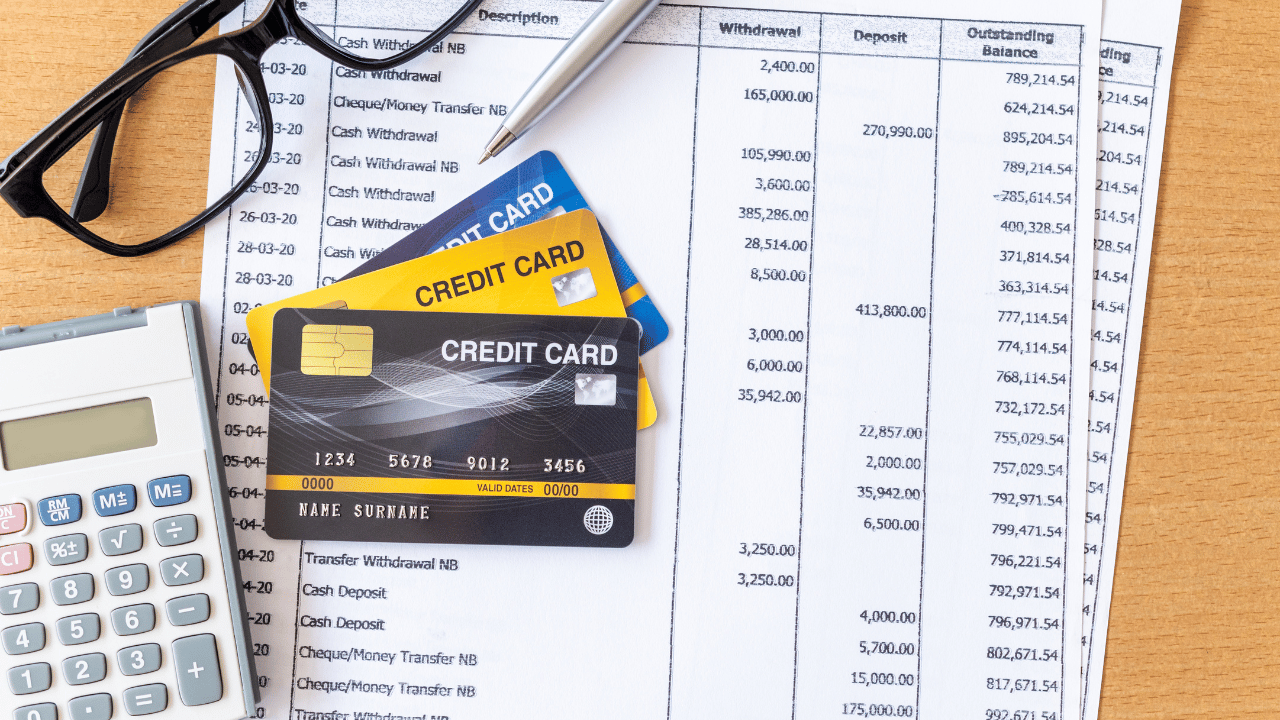

Listing Credit Card Debts :

Delve into the process of listing your credit card debts. Identify each card, outstanding balances, interest rates, and minimum payment requirements, creating a clear overview of your credit card obligations.

Establishing a Monthly Budget :

Navigate the realm of establishing a monthly budget. Learn how to allocate funds for essential expenses, savings, and credit card payments, ensuring a balanced financial plan that aligns with your goals.

Prioritizing High-Interest Cards :

Explore the significance of prioritizing high-interest credit cards. Understand the impact of interest rates on your overall debt and allocate additional funds to pay off high-interest cards more quickly, minimizing interest accrual.

Creating a Repayment Timeline :

Understand the importance of creating a repayment timeline for your credit card debts. Explore strategies such as the debt snowball or avalanche method to establish a structured plan for paying off each card within a specified timeframe.

Monitoring Spending Habits :

Delve into the realm of monitoring your spending habits. Learn how to identify and control unnecessary expenses, ensuring that you free up more funds to contribute towards credit card payments.

Conclusion :

Empower your financial journey with our guide on how to budget for credit card payments. From evaluating your financial situation to creating a repayment timeline, this comprehensive guide offers practical steps to manage credit card debt responsibly and achieve financial freedom.