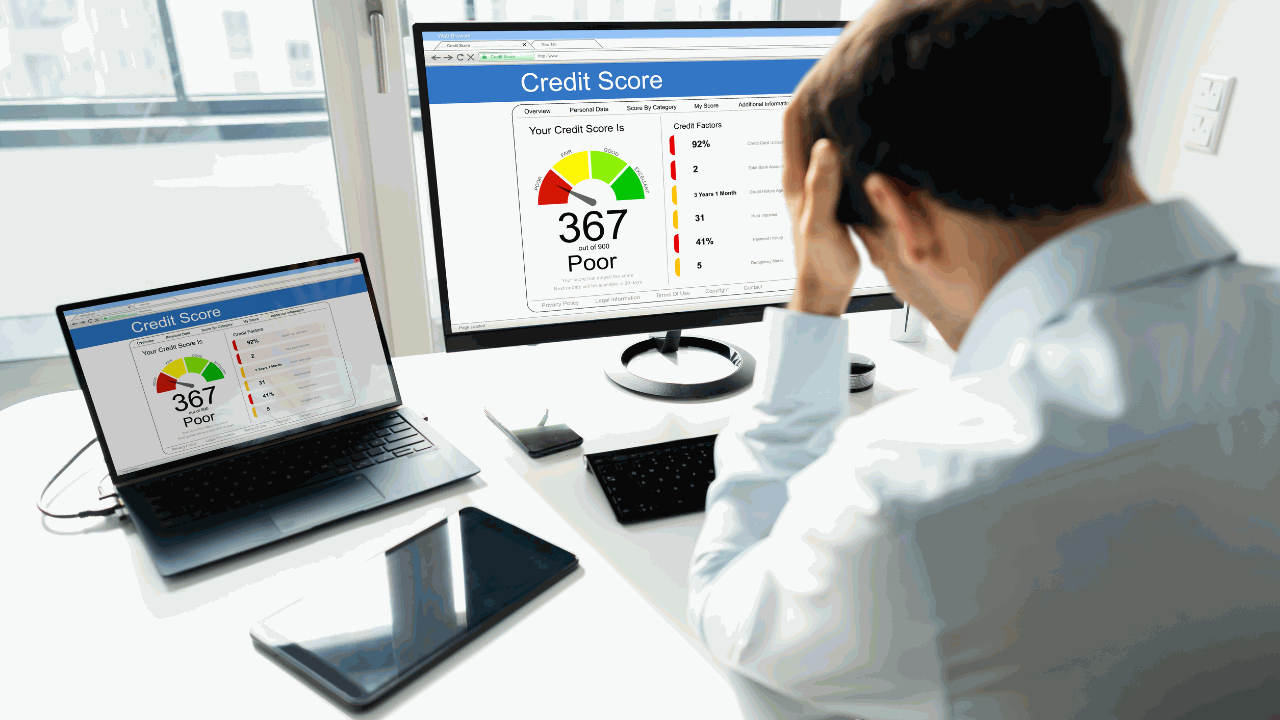

The Impact of foreclosure on your credit

The impact of foreclosure on your credit is profound, leading to a significant credit score drop and making it hard to secure new credit or loans. It stays on your credit report for seven years, affecting your financial standing during that period. Rebuilding your credit becomes essential after foreclosure.

Understanding Foreclosure :

This section offers insights into the fore closure process, its causes in the housing market, and the resulting repercussions.

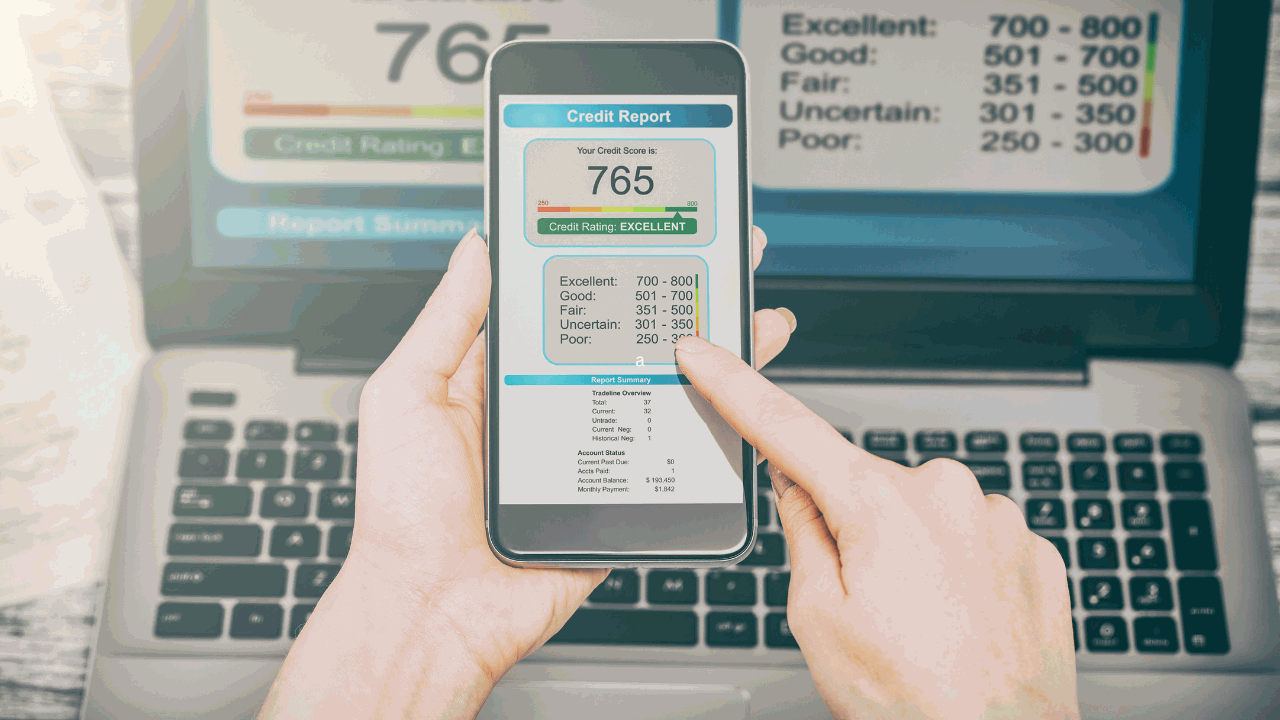

Credit Score Impact :

Explore the significant impact of foreclosure on your credit score. Understand how this event can lead to credit score reductions.

Credit Report After Foreclosure :

This section delves into the state of your credit report after a foreclosure, shedding light on how this event is recorded and its lasting impact.

Rebuilding Credit Post-Foreclosure :

Learn effective strategies for rebuilding your credit and financial stability after experiencing a foreclosure, offering hope and guidance for a brighter financial future.

Legal Aspects of Foreclosure :

Delve into the legal aspects surrounding foreclosure and how they can influence your financial situation and credit standing. Understanding the legal dimension is crucial.

Communication with Lenders :

This section highlights the importance of maintaining open communication with lenders during the foreclosure process, aiming to find mutually beneficial solutions and minimize the impact.

Foreclosure Alternatives :

Explore alternatives to foreclosure, their potential impact on your credit and financial health, and how they offer viable options to mitigate the consequences of foreclosure.

Responsible Financial Planning :

Discover the significance of responsible financial planning in averting foreclosure and safeguarding your credit. Sound financial practices are key to your financial well-being.

Credit Repair and Recovery :

Understand the steps and options available for repairing and recovering your credit after foreclosure.

Avoiding Foreclosure :

Gain insights into how to prevent foreclosure and protect your creditworthiness.