Credit Impact of Audiovisual Equipment

In today’s dynamic business environment, credit impact of audiovisual equipment has become increasingly prevalent across various industries. From presentations and conferences to digital signage and interactive displays, audiovisual technology plays a crucial role in enhancing communication and collaboration.

Importance of Audiovisual Equipment :

Audiovisual equipment encompasses a wide range of tools and devices designed to deliver high-quality audio and visual content. Whether used for internal meetings, client presentations, or marketing purposes,

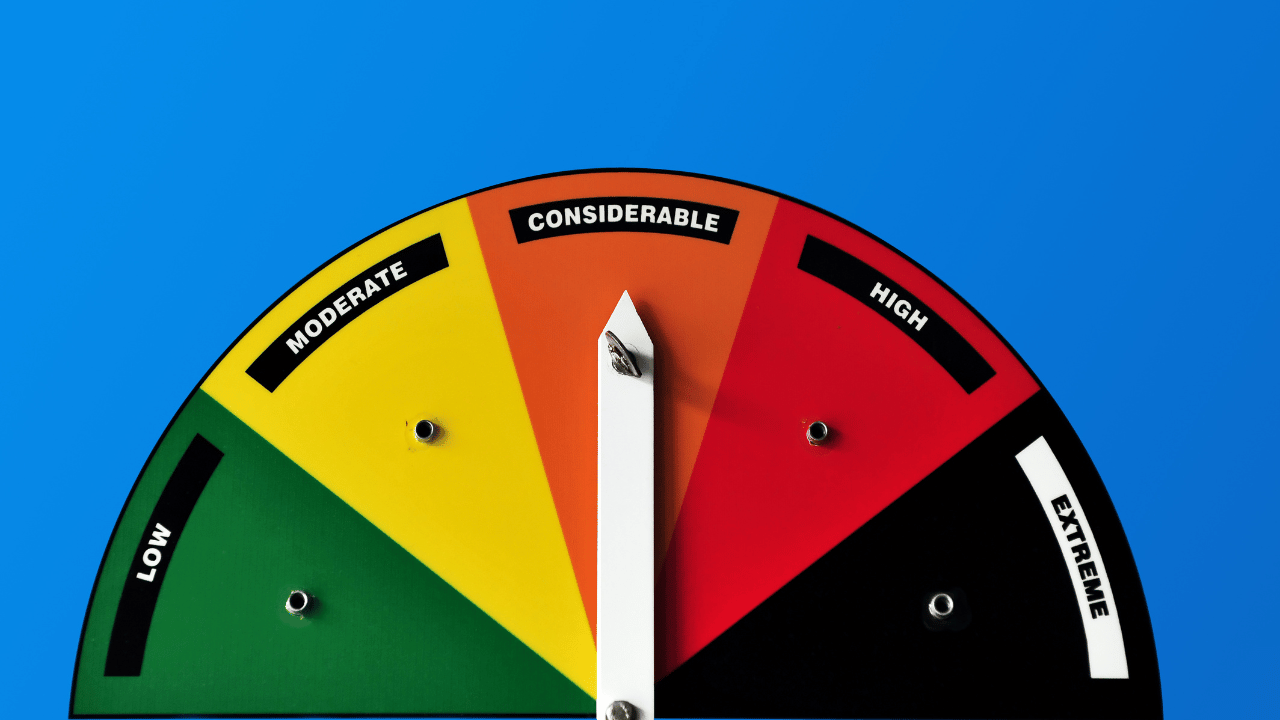

Credit Considerations :

Businesses with strong credit profiles may qualify for favorable terms and lower interest rates, while those with less favorable credit may face higher borrowing costs or stricter lending requirements.

Financing Options :

Traditional lenders, such as banks and credit unions, offer term loans and equipment financing solutions tailored to businesses’ needs. Additionally, leasing audiovisual equipment provides flexibility and may offer tax advantages commitments.

Impact on Cash Flow :

While purchasing equipment outright requires a significant upfront investment, financing options allow businesses to spread the cost over time, preserving cash for other operational expenses or investment opportunities.

Return on Investment :

While investing in state-of-the-art technology can yield productivity gains and enhance customer experiences, businesses must weigh the benefits against the costs and consider factors such as depreciation and obsolescence.

Credit Management Strategies :

To mitigate the credit impact of audiovisual equipment, businesses should implement effective credit management strategies. This includes maintaining a strong credit profile through timely payments, managing debt levels .

implementing sound credit :

By understanding the factors that affect creditworthiness, exploring financing options, and implementing sound credit management practices, businesses can navigate the complexities of acquiring audiovisual equipment while maintaining financial stability and driving growth.

Conclusion :

Explore the credit impact of audiovisual equipment and its implications for businesses seeking financing. Learn about financing options, cash flow considerations, return on investment, and credit management strategies to make informed decisions and optimize financial performance.