Mixing and Blending Equipment Leasing

Explore the significant credit influence on mixing and blending equipment leasing. Learn how credit scores affect leasing terms and discover strategies to improve your credit profile for better leasing opportunities.

Importance of Mixing and Blending Equipment :

Understand the crucial role of mixing and blending equipment in various industries, from food production to pharmaceuticals. Leasing this equipment can be more cost-effective but hinges on credit considerations.

Impact on Lease Approval :

Higher credit scores positively influence lease approval for mixing and blending equipment. A strong credit profile increases the likelihood of securing leases, ensuring timely access to essential machinery.

Effect on Interest Rates and Lease Terms :

Learn how credit scores impact interest rates and lease terms. Better credit scores often lead to lower interest rates and more favorable terms, reducing the overall cost of leasing equipment.

Assessing Credit Risk for Lessors :

Understand how lessors assess credit risk when leasing mixing and blending equipment. A high credit score signals lower risk, making it easier to negotiate better leasing conditions.

Benefits of Maintaining a Good Credit Score :

Explore the benefits of maintaining a good credit score. Advantages include quicker lease approvals, reduced costs, and access to high-quality equipment, which enhances operational efficiency.

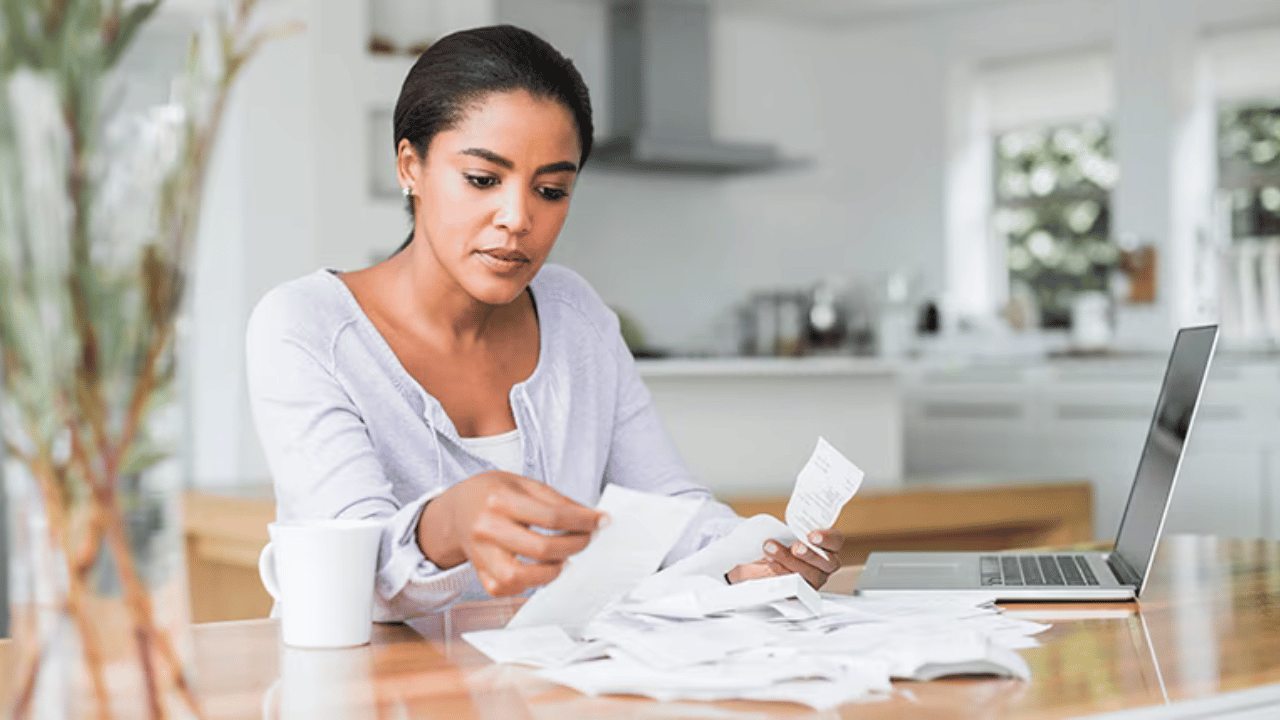

Strategies to Improve Your Credit Score :

Implement practical strategies to improve your credit score. Consistent timely payments, lowering outstanding debts, and regularly monitoring your credit report can boost your creditworthiness.

Alternative Financing Options :

Consider alternative financing options if your credit score is less than ideal. Options such as secured loans, co-signers, or working with specialized leasing providers can help secure necessary equipment.

Managing Credit for Better Leasing Opportunities :

Summarize the key points about the credit influence on mixing and blending equipment leasing. Emphasize the importance of effective credit management to secure favorable leasing terms and support business growth.

Conclusion :

By understanding the credit influence on mixing and blending equipment leasing, businesses can strategically manage their credit to obtain favorable leasing terms, ensuring access to essential equipment and supporting operational success.