Personal Loan to Consolidate Credit Card Debt

If you find yourself drowning in credit card debt, you’re not alone. Many people struggle with high-interest credit card balances that seem to never go away. However, there’s a financial lifeline that can help you regain control of your finances: a personal loan. In this guide, we’ll explore how you can use a personal loan to consolidate credit card debt effectively and pave the way toward financial freedom.

Understanding Personal Loans

Before we dive into the process of consolidating credit card debt with a personal loan, let’s first understand what a personal loan is. A personal loan is an unsecured loan that you can borrow from a bank, credit union, or online lender. Unlike credit cards, personal loans typically come with a fixed interest rate, a set repayment term, and a fixed monthly payment. This predictability can make personal loans an excellent choice for debt consolidation.

Benefits of Consolidating Credit Card Debt with a Personal Loan

Lower Interest Rates :

One of the most significant advantages of using a personal loan to consolidate credit card debt is the potential for lower interest rates. Credit cards often come with high APRs (Annual Percentage Rates), making it challenging to make a dent in your debt. Personal loans, on the other hand, frequently offer lower interest rates, especially if you have good credit. By securing a personal loan with a lower interest rate than your credit cards, you can save money on interest charges.

Fixed Monthly Payments :

Credit card payments can vary from month to month, depending on your outstanding balance and interest rates. This unpredictability can make budgeting a nightmare. Personal loans, however, come with fixed monthly payments. Knowing exactly how much you need to pay each month simplifies your budgeting process and ensures you stay on track to pay off your debt.

Clear Debt Repayment Timeline :

Personal loans also come with a clear debt repayment timeline. You’ll know precisely when your debt will be paid off, provided you make your payments on time. This transparency can be motivating, as you can see the light at the end of the tunnel.

Steps to Consolidate Credit Card Debt with a Personal Loan

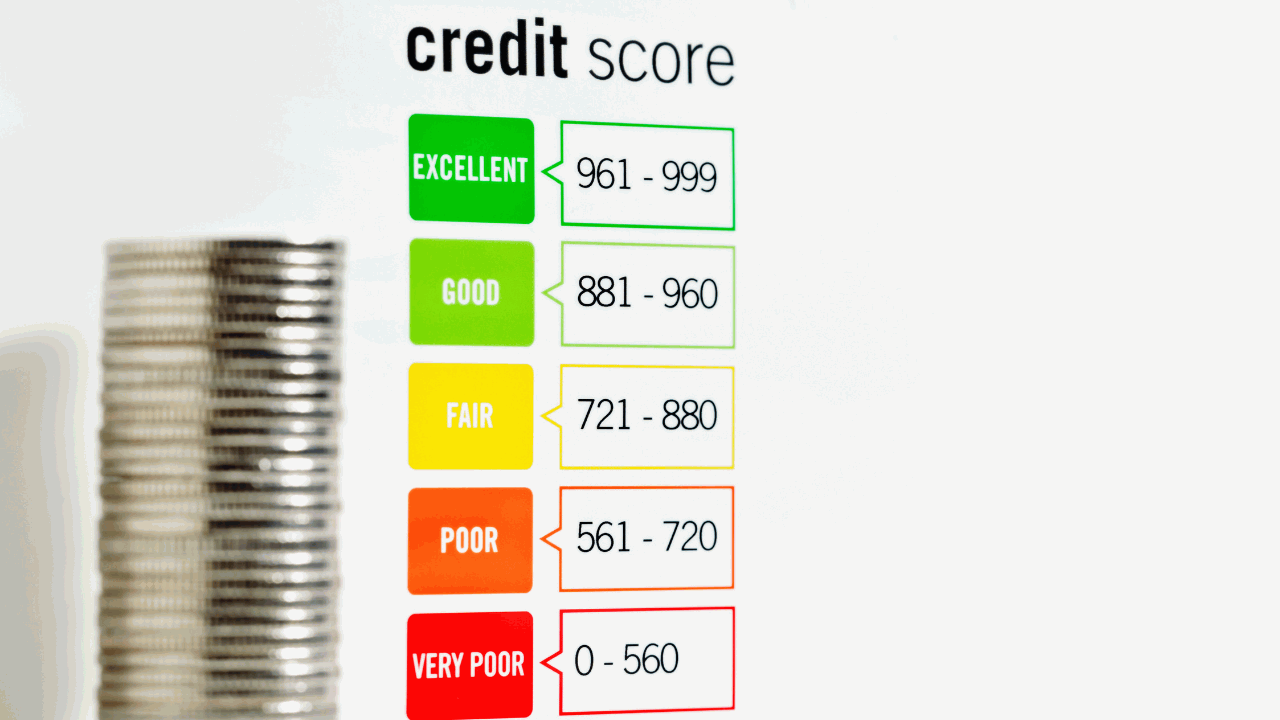

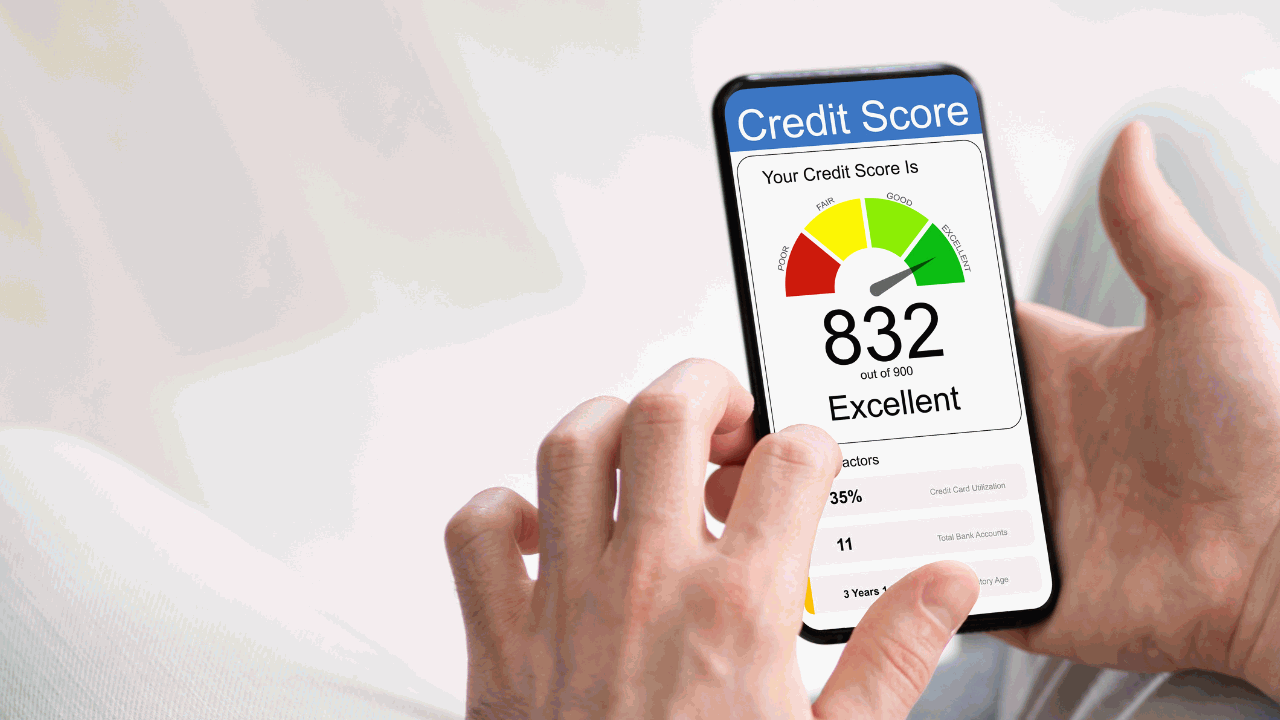

1. Assess Your Credit Score

Before applying for a personal loan, check your credit score. Lenders use your credit score to determine your eligibility and the interest rate you’ll receive. A higher credit score often translates to better loan terms. If your credit score needs improvement, take steps to boost it before applying for a loan.

2. Shop Around for the Best Personal Loan

Don’t settle for the first personal loan offer you receive. Shop around and compare offers from different lenders. Look for a loan with a lower interest rate, favorable terms, and minimal fees.

3. Calculate Your Total Debt

Determine the total amount of credit card debt you want to consolidate. This will help you request the right loan amount.

4. Apply for the Personal Loan

Once you’ve found a suitable personal loan, apply for it. Be prepared to provide documentation such as proof of income, employment history, and identification.

5. Use the Loan to Pay Off Your Credit Cards

Once your personal loan is approved, use the funds to pay off your credit card balances in full. This simplifies your debt into a single monthly payment.

6. Stick to Your Payment Plan

Make consistent, on-time payments toward your personal loan. Avoid using your credit cards while paying off the loan to prevent further debt accumulation.

Conclusion

Consolidating credit card debt with a personal loan can be a smart financial move if done correctly. Lower interest rates, fixed monthly payments, and a clear repayment timeline can help you regain control of your finances. However, it’s essential to shop around for the best loan terms and commit to responsible financial habits to ensure a successful debt consolidation journey. With determination and discipline, you can use a personal loan to pave your way to a debt-free future.