Create a Budget and Stick to It

A budget is a powerful financial tool that allows you to take control of your money, track your expenses, and achieve your financial goals. However, creating a budget is just the first step. The real challenge lies in sticking to it consistently. In this blog post, we will guide you through the process of creating an effective budget and provide practical tips to help you stay on track.

Assess Your Income and Expenses:

- Calculate Your Income: Determine your total monthly income, including wages, freelance work, side gigs, and any other sources of income.

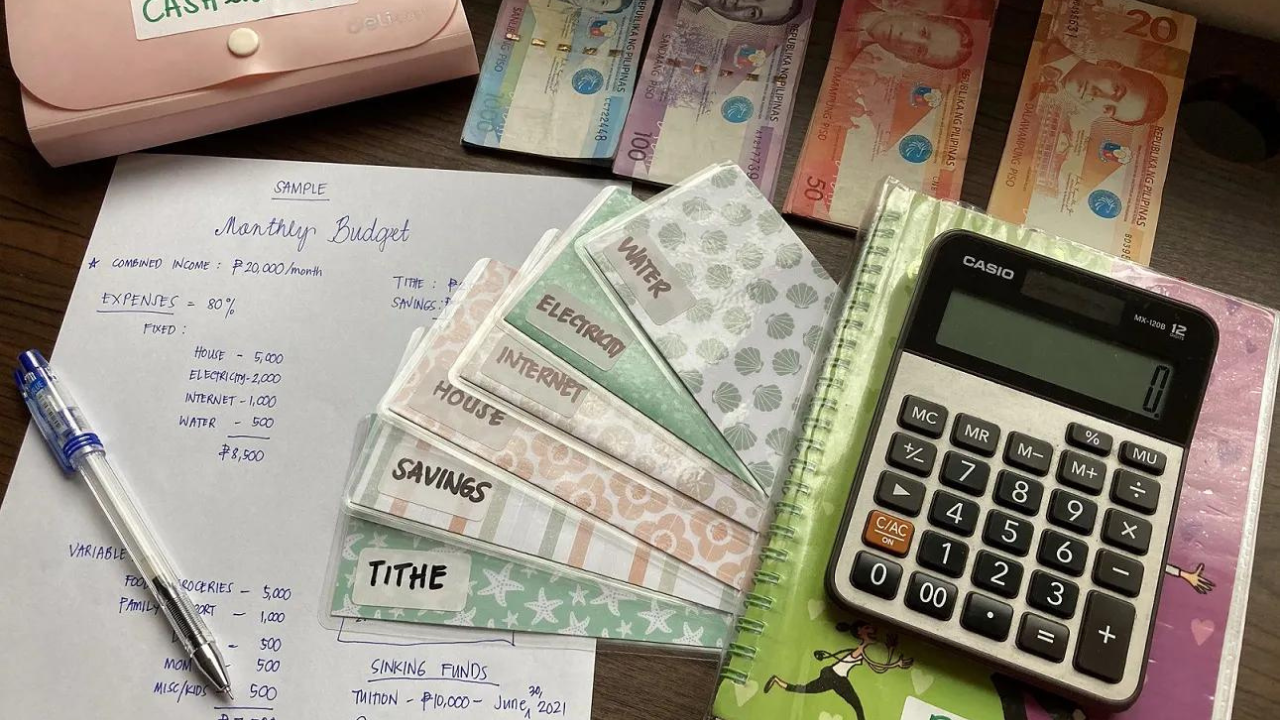

- Track Your Expenses: Review your bank statements, receipts, and bills to get a clear picture of your spending habits. Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment).

Set Financial Goals:

- Define Your Goals: Identify your short-term and long-term financial goals, such as paying off debt, saving for a down payment, or building an emergency fund.

- Prioritize Your Goals: Determine which goals are most important to you and allocate a portion of your budget towards achieving them.

Create Your Budget:

- Income vs. Expenses: Compare your income to your expenses to ensure that you are not spending more than you earn.

- Allocate Funds: Assign specific amounts to each expense category based on your priorities and available income. Don’t forget to allocate funds for savings and unexpected expenses.

Dave Ramsey – How to Make a Budget

Track Your Spending:

- Use Budgeting Apps: Explore mobile apps and online tools that help you track your expenses and monitor your budget in real-time.

- Keep Receipts: Save receipts for all your purchases, or use digital tools to capture and categorize your expenses.

Adjust and Fine-Tune Your Budget:

- Review Regularly: Set aside time each month to review your budget and make adjustments as needed. Take into account any changes in income, expenses, or financial goals.

- Find Areas to Cut Back: Identify areas where you can reduce expenses or find more cost-effective alternatives.

Money Crashers – How to Adjust Your Budget

Stay Disciplined and Motivated:

- Track Your Progress: Regularly monitor your spending and savings to see how well you’re sticking to your budget and achieving your financial goals.

- Celebrate Milestones: Recognize and celebrate your achievements along the way, whether it’s paying off a debt or reaching a savings target.

The Simple Dollar – 10 Strategies for Sticking to Your Budget

Conclusion

Creating a budget and sticking to it requires discipline and commitment, but the rewards are worth it. By assessing your income and expenses, setting financial goals, and creating a detailed budget, you can take control of your finances and make informed spending decisions. Regularly tracking your expenses, making necessary adjustments, and staying motivated will help you stay on track and achieve your financial aspirations. Remember, a budget is a flexible tool that can adapt to your changing financial circumstances, so make sure to review and update it regularly.