Earthworks and Excavation Equipment Leasing

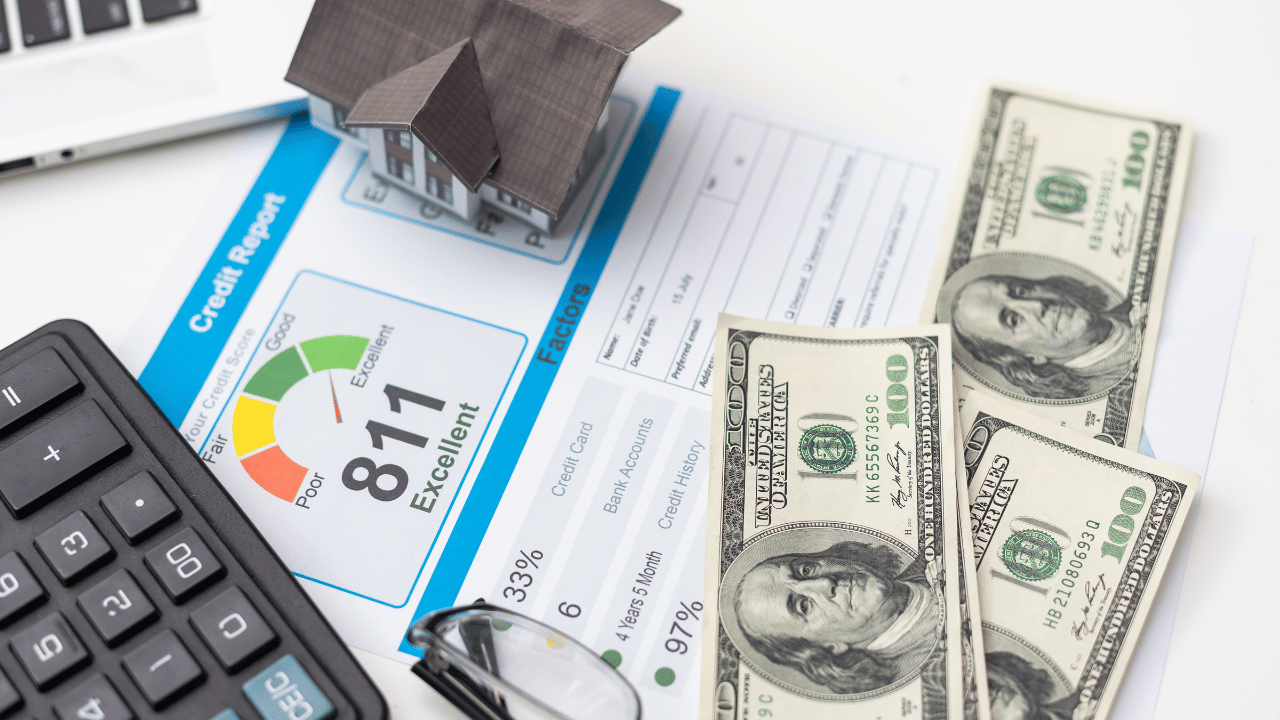

Explore how credit scores impact the leasing of earthworks and excavation equipment in this insightful blog. Understand the importance of creditworthiness in securing favorable lease terms and conditions.

The Role of Credit Scores in Equipment Leasing :

Learn about the critical role of credit scores in leasing earthworks and excavation equipment. Discover why creditworthiness is a key factor for both lessors and lessees in the construction industry.

Credit Scores and Lease Approval :

Understand how credit scores influence the approval process for leasing earthworks and excavation equipment. Higher credit scores increase the likelihood of lease approval and access to better terms.

Impact on Lease Terms and Conditions :

Explore how credit scores affect the terms and conditions of equipment leases. Businesses with strong credit scores often receive more favorable rates, flexible payment plans, and longer lease durations.

Assessing Credit Risk :

Discover how lessors assess credit risk using credit scores. Learn how a business’s creditworthiness can affect the perceived risk and the strategies lessors use to mitigate these risks.

Benefits of a Strong Credit Score :

Examine the benefits of maintaining a strong credit score when leasing earthworks and excavation equipment. Benefits include lower costs, easier approval processes, and improved negotiation power.

Improving Your Credit Score :

Learn practical steps to improve your credit score to enhance leasing opportunities. Timely payments, reducing outstanding debts, and regular credit monitoring can significantly improve your credit profile.

Alternative Financing Options :

Consider alternative financing options for businesses with lower credit scores. Options such as secured loans, co-signers, or leasing from specialized providers can provide viable solutions. Additionally, exploring government grants or subsidies can also be beneficial.

Conclusion :

By understanding the impact of credit scores on leasing earthworks and excavation equipment, businesses can strategically improve their creditworthiness, ensuring access to favorable lease terms and supporting their operational needs.