Credit Mistakes When Buying a Car

When it comes to purchasing a car, your credit plays a pivotal role in determining the terms of your auto loan. A strong credit score can open doors to favorable interest rates and loan conditions, potentially saving you a substantial amount of money. On the other hand, making common credit mistakes can lead to higher costs and financial stress. In this guide, we’ll explore essential tips to help you avoid these pitfalls and secure a car loan that suits both your needs and budget.

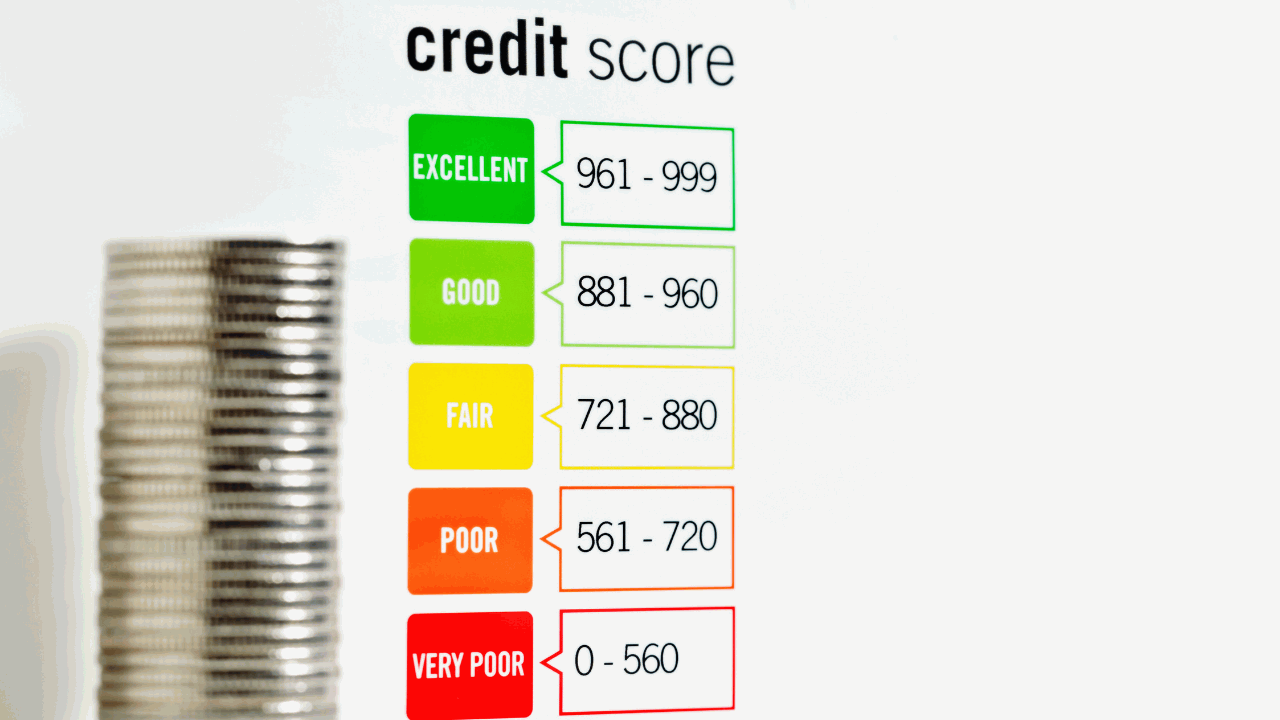

Understanding the Importance of Your Credit Score :

Your credit score is a numerical representation of your creditworthiness. Lenders use this score to assess the risk of lending you money, including auto loans. The higher your credit score, the more likely you are to qualify for lower interest rates and better loan terms. Here are some key steps to consider when navigating the car-buying process:

Check Your Credit Score in Advance:

Before you start shopping for a car, it’s crucial to know where you stand in terms of your credit. Obtain a copy of your credit report from one of the major credit bureaus – Equifax, Experian, or TransUnion. Review it carefully for any errors or discrepancies that might be dragging down your score.

Set a Realistic Budget:

Based on your credit score and financial situation, establish a realistic budget for your car purchase. Be sure to consider not only the vehicle’s price but also ongoing expenses like insurance, fuel, and maintenance. Staying within your budget is essential for maintaining good credit health.

Avoid Applying for Multiple Loans

Every time you apply for a car loan, a hard inquiry is made on your credit report. Multiple inquiries within a short period can negatively impact your credit score. To minimize this risk, research lenders and their credit requirements before submitting applications.

Focus on Improving Your Credit Score:

If your credit score is less than ideal, take proactive steps to boost it before applying for a car loan. Paying bills on time, reducing outstanding debts, and addressing any errors on your credit report can all contribute to a better score.

Shop for the Best Interest Rates :

Interest rates can vary significantly among lenders. Don’t settle for the first loan offer you receive. Instead, shop around and compare offers from various financial institutions, including banks, credit unions, and online lenders.

Consider a Co-Signer:

If your credit score is preventing you from securing a favorable auto loan, you might consider asking a trusted friend or family member to co-sign the loan. A co-signer with strong credit can help you qualify for better terms.

Read the Fine Print:

Before finalizing your auto loan, carefully review the terms and conditions of the agreement. Pay attention to the interest rate, loan duration, and any additional fees. Make sure you understand all aspects of the loan to avoid unexpected surprises.

Conclusion

Your credit score significantly influences your ability to finance a car and the cost of that financing. By taking steps to understand and improve your credit, setting a realistic budget, and shopping for the best loan terms, you can avoid common credit mistakes when buying a car. Making informed decisions will not only save you money but also set you on the path to financial stability and a brighter automotive future.