Considerations for Music Financing

Luxury financing offers individuals the opportunity to acquire high-end goods and services, from luxury vehicles to designer homes. However, the terms and rates of these financing options are often influenced by an individual’s creditworthiness. In this blog, we delve into the significant impact that credit scores on luxury financing can have on the borrowing process.

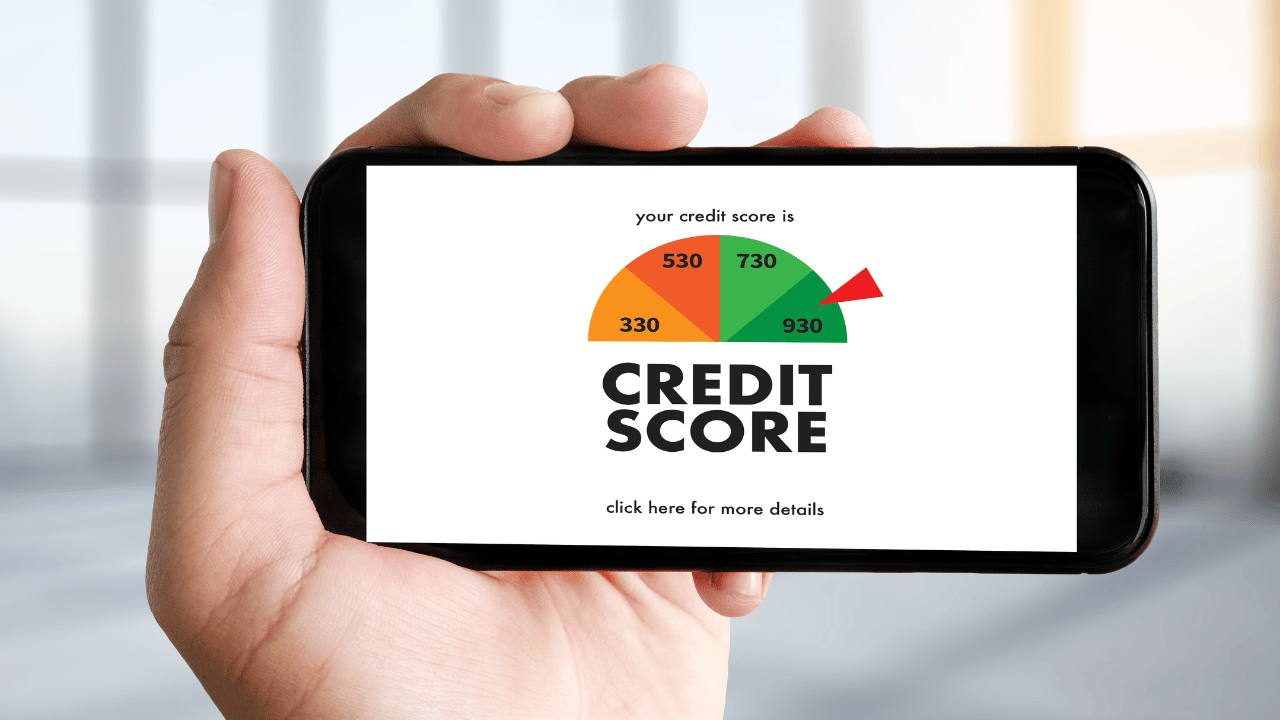

Understanding Credit Scores :

Credit scores are numerical representations of an individual’s creditworthiness, based on factors such as payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries.

Influence on Interest Rates :

A high credit score demonstrates a history of responsible financial behavior, making the borrower less risky from the lender’s perspective. As a result, individuals with excellent credit scores may qualify for more favorable financing terms.

Access to Exclusive Financing Options :

Lenders may offer customized financing packages with competitive rates and flexible terms tailored to the borrower’s financial profile. This allows individuals with excellent credit to access high-value luxury assets while optimizing their financial resources.

Negotiating Power :

With multiple lenders vying for their business, borrowers can leverage their strong creditworthiness to negotiate lower interest rates, reduced fees, and other favorable terms, ultimately saving money over the life of the financing agreement.

Impact on Loan Approval :

Lenders use credit scores as a key determinant when assessing the borrower’s eligibility for financing. While individuals with lower credit scores may still qualify for luxury financing, they may face higher interest rates and stricter borrowing requirements.

Building and Maintaining Credit :

By making timely payments, keeping credit card balances low, and avoiding excessive credit inquiries, borrowers can improve their credit scores over time, thereby enhancing their eligibility for favorable financing terms.

credit history :

The influence of credit scores on luxury financing cannot be overstated. A strong credit profile opens doors to competitive interest rates, exclusive financing options, and greater negotiating power in the luxury market.

Conclusion :

Explore how credit scores on luxury financing impact borrowing terms, interest rates, and access to exclusive financing options in the luxury market. Learn how a strong credit profile can enhance negotiating power and eligibility for favorable financing terms in the pursuit of high-end assets and lifestyle aspirations.