Considerations When Applying for Online Loans

Gain insight into the importance of credit scores when applying for online loans. Learn how lenders use credit scores to assess borrowers’ creditworthiness and determine loan eligibility and terms.

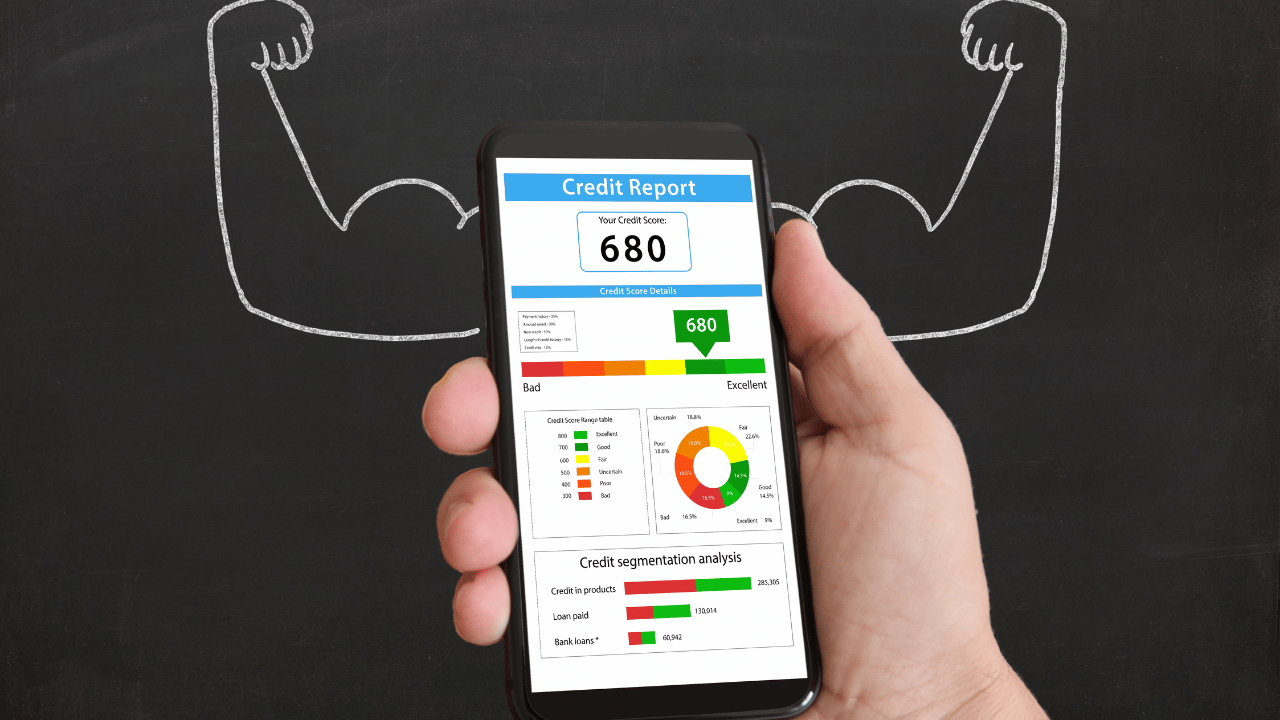

Impact of Credit Scores :

Explore how credit scores can affect the approval process and terms of online loans. Understand how higher credit scores can lead to lower interest rates and more favorable loan terms, while lower credit scores may result in higher interest rates or loan denials.

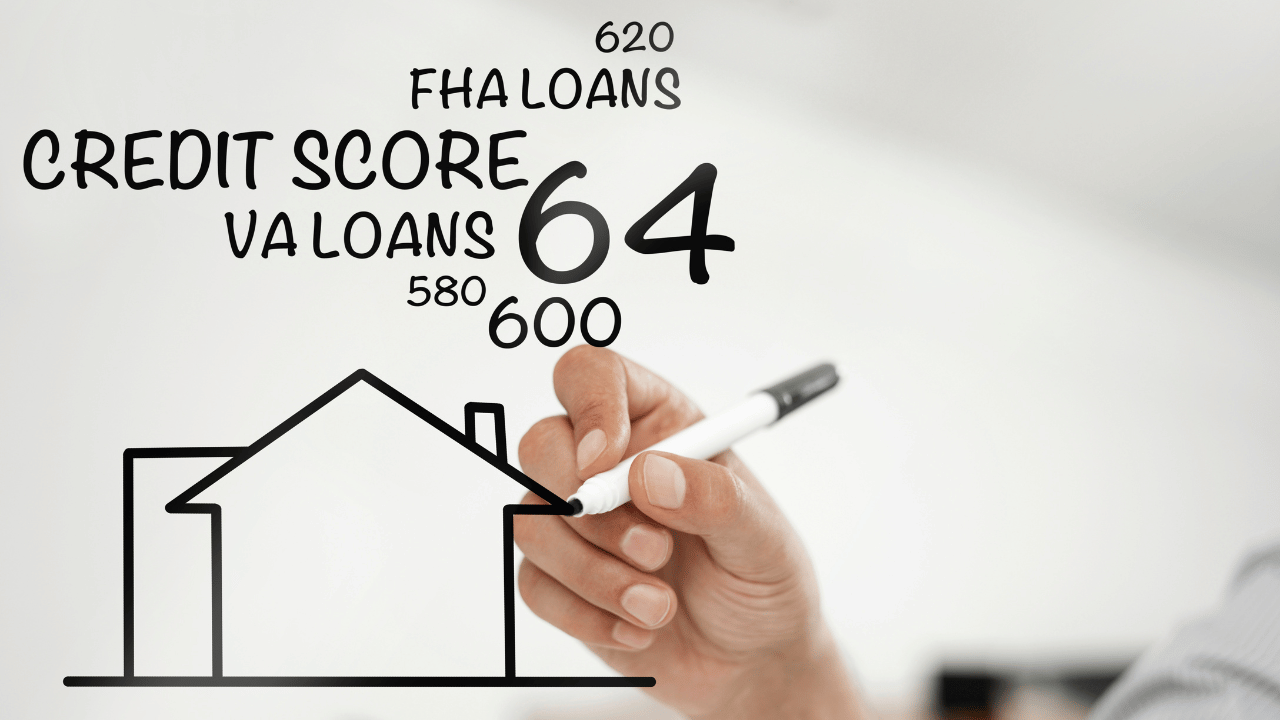

Credit Score Requirements :

Discover the typical credit score requirements for various types of online loans, including personal loans, payday loans, and installment loans. Learn what credit score range is considered good or bad for loan approval.

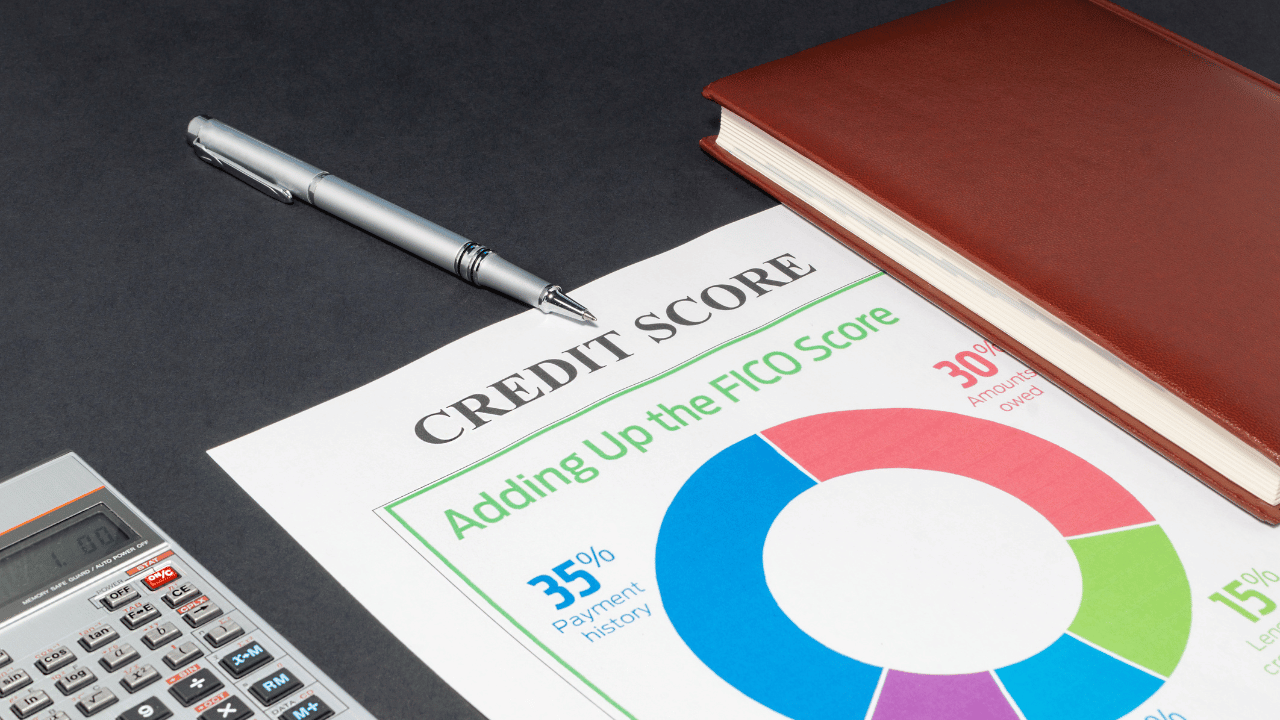

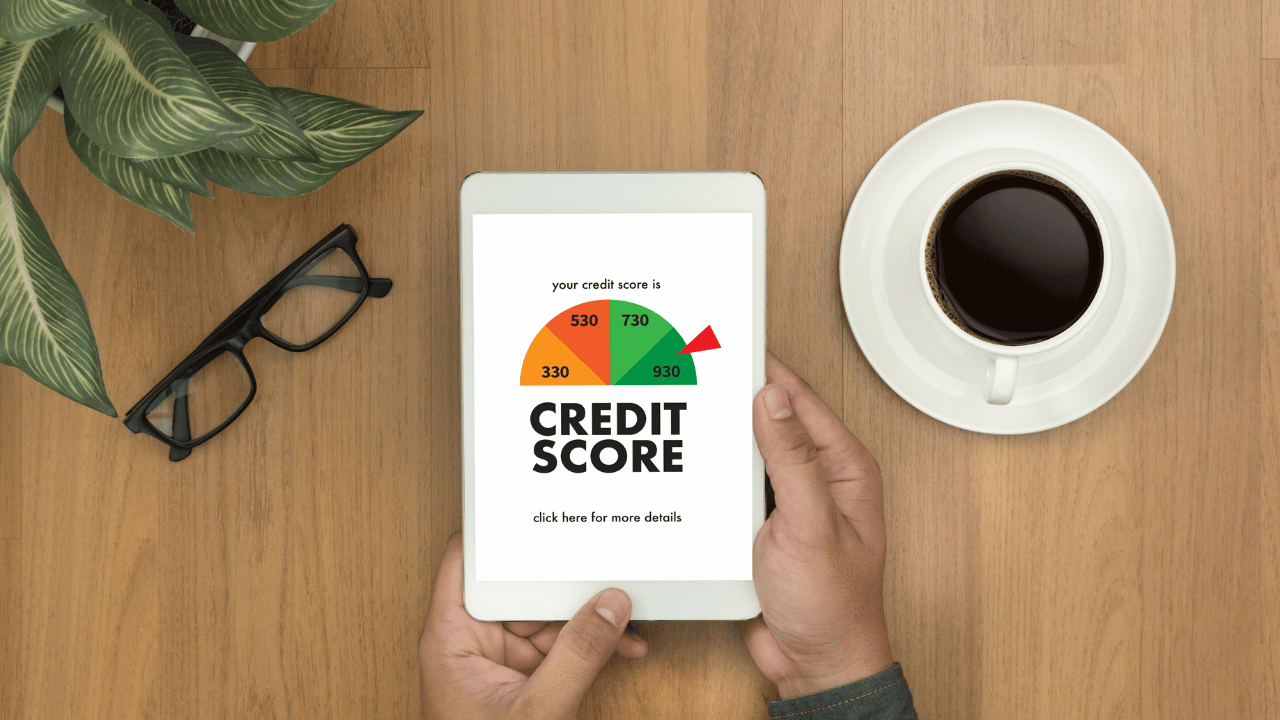

Improving Credit Scores :

Explore strategies for improving credit scores to increase chances of loan approval and secure better loan terms. Learn about factors that influence credit scores, such as payment history, credit utilization, and length of credit history, and how to address them.

Alternative Lending Options :

Consider alternative lending options for borrowers with less-than-perfect credit scores. Explore online lenders that specialize in bad credit loans or offer flexible eligibility criteria, such as income-based loans or secured loans.

Comparing Loan Offers :

Learn how to compare loan offers from different online lenders based on interest rates, fees, repayment terms, and eligibility requirements. Understand the importance of shopping around and reading the fine print before committing to a loan.

Avoiding Predatory Lenders :

Be aware of red flags for predatory lending practices when applying for online loans, such as high-pressure sales tactics, hidden fees, and excessively high interest rates. Learn how to identify reputable lenders and protect yourself from scams.

Monitoring Credit Health :

Understand the importance of regularly monitoring your credit health, including checking your credit report for errors and reviewing your credit score. Take proactive steps to maintain or improve your credit score to qualify for better loan offers in the future.

Conclusion :

Navigate applying for online loans lending landscape with confidence by understanding how credit scores impact loan approvals and terms. Learn valuable tips for improving credit scores, comparing loan offers, and avoiding predatory lenders when applying for online loans.