Credit Scores on Speech Therapy Financing Rates

In this section, introduce the topic of the blog, highlighting the importance of credit scores in accessing financing for speech therapy financing rates services. Explain how creditworthiness can affect the rates and terms offered by lenders for such specialized healthcare services.

Understanding Speech Therapy Financing :

Provide an overview of speech therapy financing, discussing the various funding options available to individuals seeking these services. Mention traditional loans, healthcare financing programs, and other payment arrangements commonly used to cover speech therapy expenses.

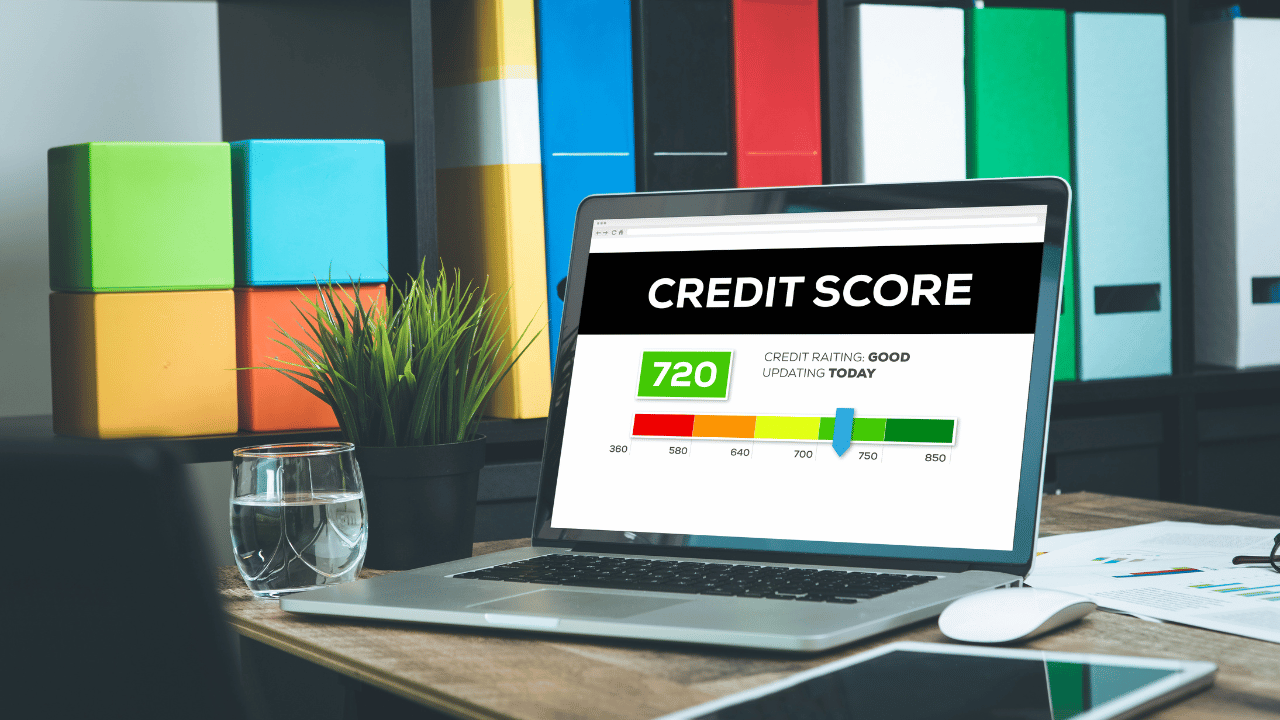

Importance of Credit Scores :

Explore the significance of credit scores in the context of speech therapy financing. Discuss how lenders assess creditworthiness based on factors such as credit history, payment behavior, and debt-to-income ratio when determining loan eligibility and interest rates.

Impact on Financing Rates :

Detail how credit scores directly influence the financing rates offered to individuals seeking speech therapy services. Explain how borrowers with higher credit scores may qualify for lower interest rates, resulting in more affordable financing options compared to those with lower credit scores.

Access to Quality Care :

Highlight the connection between credit scores and access to quality speech therapy services. Discuss how individuals with favorable credit profiles may have an easier time securing financing, allowing them to access timely and comprehensive speech therapy interventions.

Addressing Credit Challenges :

Offer strategies for individuals with less-than-perfect credit to improve their creditworthiness and secure favorable financing rates for speech therapy. Discuss options such as credit counseling, debt consolidation, and building positive credit habits.

Advocating for Affordable Care :

Encourage advocacy efforts to promote affordable access to speech therapy services for all individuals, regardless of their credit scores. Discuss the importance of financial assistance programs, insurance coverage, and community support in ensuring equitable access to speech therapy.

affordable speech therapy :

Summarize the key points discussed in the blog, emphasizing the critical role of credit scores in speech therapy financing rates. Encourage readers to prioritize financial health and explore available resources to access affordable speech therapy services.

Conclusion :

Learn about the impact of credit scores on speech therapy financing rates and discover how creditworthiness can affect access to quality care. Explore strategies for improving credit and advocating for affordable speech therapy services for all individuals.