In today’s digital world, virtual credit cards have emerged as a powerful tool for managing finances and improving credit scores. At Credit Repair Champ, we’re dedicated to helping you leverage these modern solutions for effective credit repair. This article will guide you through the benefits and strategic use of virtual credit cards to enhance your credit score and protect your financial health.

What Are Virtual Credit Cards?

A virtual credit card is a digital version of a physical credit card, designed to be used for online transactions. These cards offer a unique card number, expiration date, and CVV code, often linked to your existing credit card account. They provide an added layer of security by masking your actual credit card details during online purchases.

Benefits of Using Virtual Credit Cards for Credit Repair

Enhanced Security

One of the primary advantages of virtual credit cards is enhanced security. By using a virtual card, you minimize the risk of fraud, as your real credit card information is never exposed during transactions. This is particularly beneficial when shopping on unfamiliar websites.

Controlled Spending

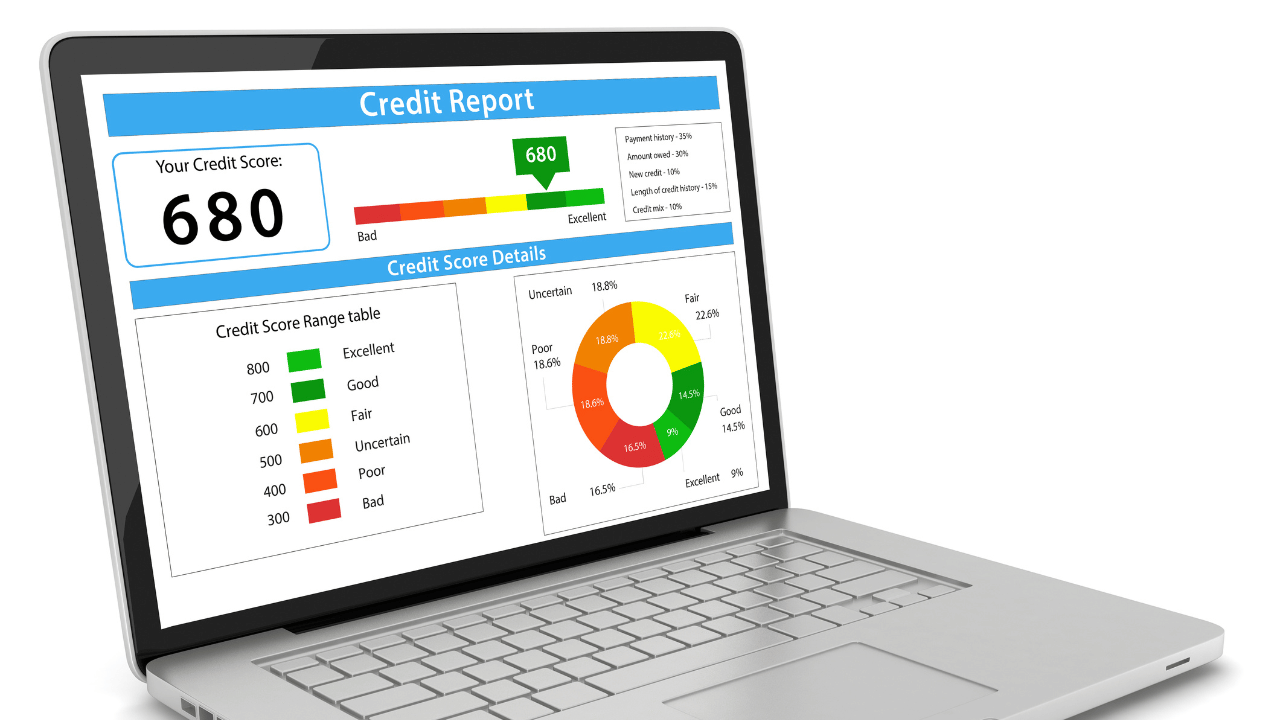

Virtual credit cards allow you to set spending limits, which can help you manage your finances more effectively. By setting a strict limit, you can prevent overspending, which is crucial for maintaining a healthy credit utilization ratio—a key factor in your credit score.

Easy Tracking of Payments

Using virtual credit cards can make it easier to track and manage payments, especially if you dedicate specific virtual cards to different types of expenses. This organized approach can help you ensure that all bills are paid on time, further contributing to a positive credit history.

How to Use Virtual Credit Cards for Credit Repair

Set Up Virtual Cards for Recurring Payments

One effective strategy is to use virtual credit cards for recurring payments, such as subscriptions and utility bills. By ensuring these payments are made on time, you can build a consistent payment history, which positively impacts your credit score.

Monitor and Adjust Spending Limits

Virtual credit cards allow you to adjust spending limits according to your budget. Regularly monitor and modify these limits to ensure you stay within your financial means. Keeping your credit utilization low is vital for improving your credit score.

Use Virtual Cards for Online Shopping

When shopping online, use virtual credit cards to safeguard your primary credit card details. This not only protects you from potential fraud but also allows you to control spending, ensuring that you do not exceed your budget.

Regularly Review Statements

Regularly review your virtual credit card statements to identify any discrepancies or unauthorized charges. Promptly addressing these issues can prevent them from negatively impacting your credit score.

The Role of Virtual Credit Cards in Building Credit

By strategically using virtual credit cards, you can maintain better control over your finances and ensure timely payments, both of which are crucial for building and repairing your credit. Additionally, the security features of virtual cards protect you from fraud, which can otherwise damage your credit score.

Conclusion

Virtual credit cards offer a modern solution for credit repair, providing enhanced security, controlled spending, and ease of payment tracking. By integrating virtual credit cards into your financial strategy, you can protect your credit score and work towards a stronger financial future.