Considerations for HVAC Equipment Leasing

In the realm of business financing, credit scores play a crucial role in determining eligibility and terms for various types of leases, including those for HVAC (Heating, Ventilation, and Air Conditioning) equipment. This guide explores the credit score considerations for HVAC equipment leasing and offers insights into how businesses can navigate this aspect of financing.

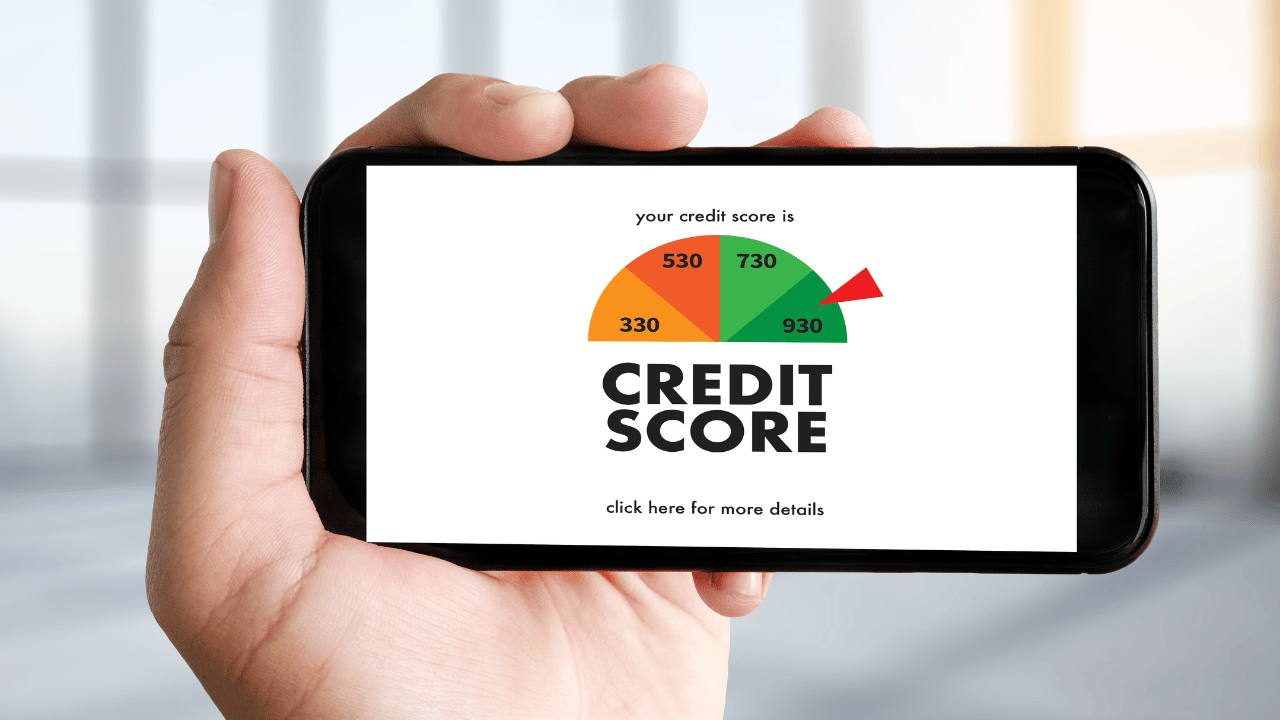

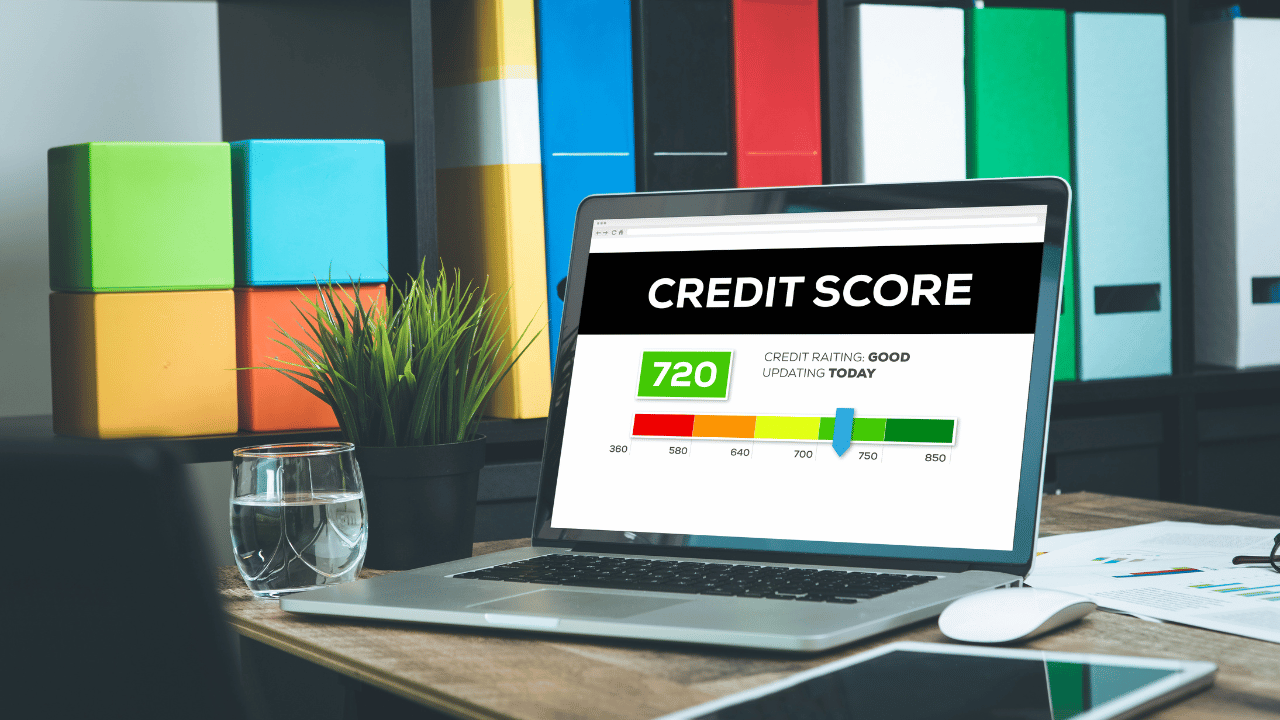

Understanding Credit Scores:

Credit scores are numerical representations of an individual or business’s creditworthiness, based on their credit history and financial behavior. Lenders use these scores to assess the risk associated with extending credit or financing.

Impact on Lease Approval :

When applying for an HVAC equipment lease, businesses with higher credit scores generally have a better chance of approval and may qualify for more favorable lease terms. Lenders perceive higher credit scores as indicative of lower risk.

Factors Influencing Credit Scores :

Several factors contribute to determining a business’s credit score, including payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries. Maintaining a positive payment history.

Importance of Creditworthiness :

For businesses seeking HVAC equipment leases, having a solid credit profile is paramount. A higher credit score not only increases the likelihood of lease approval but also opens doors to more favorable financing options.

Building and Maintaining Good Credit :

Businesses can take proactive steps to improve their creditworthiness and enhance their chances of securing favorable HVAC equipment leases. This includes making timely payments on existing debts accuracy.

Alternative Financing Options :

In cases where businesses have lower credit scores or limited credit history, alternative financing options may be available. These may include lease options specifically designed for businesses with less-than-perfect credit .

Consultation and Expert Advice :

Seeking guidance from financial advisors or lease specialists can provide valuable insights and assistance in understanding the best financing options based on individual business needs and credit circumstances.

Conclusion :

Discover the credit score considerations for HVAC equipment leasing and learn how businesses can leverage their creditworthiness to secure favorable lease terms. Understand the impact of credit scores on lease approval, factors influencing creditworthiness, and proactive steps to improve credit profiles for better leasing opportunities.