Credit Scores Shape Working Capital Loan Rates

Embark on a journey through the financial landscape as we unravel the intricate relationship between credit scores and the interest rates associated with working capital loans. Gain a profound understanding of the pivotal role credit scores play in influence rates for working.

Scoring Mechanism for Working Capital Loans :

Delve into the specifics of credit scoring mechanisms and how they impact the rates assigned to working capital loans. Uncover the factors that contribute to a borrower’s credit score and understand the direct correlation to the interest rates they are offered.

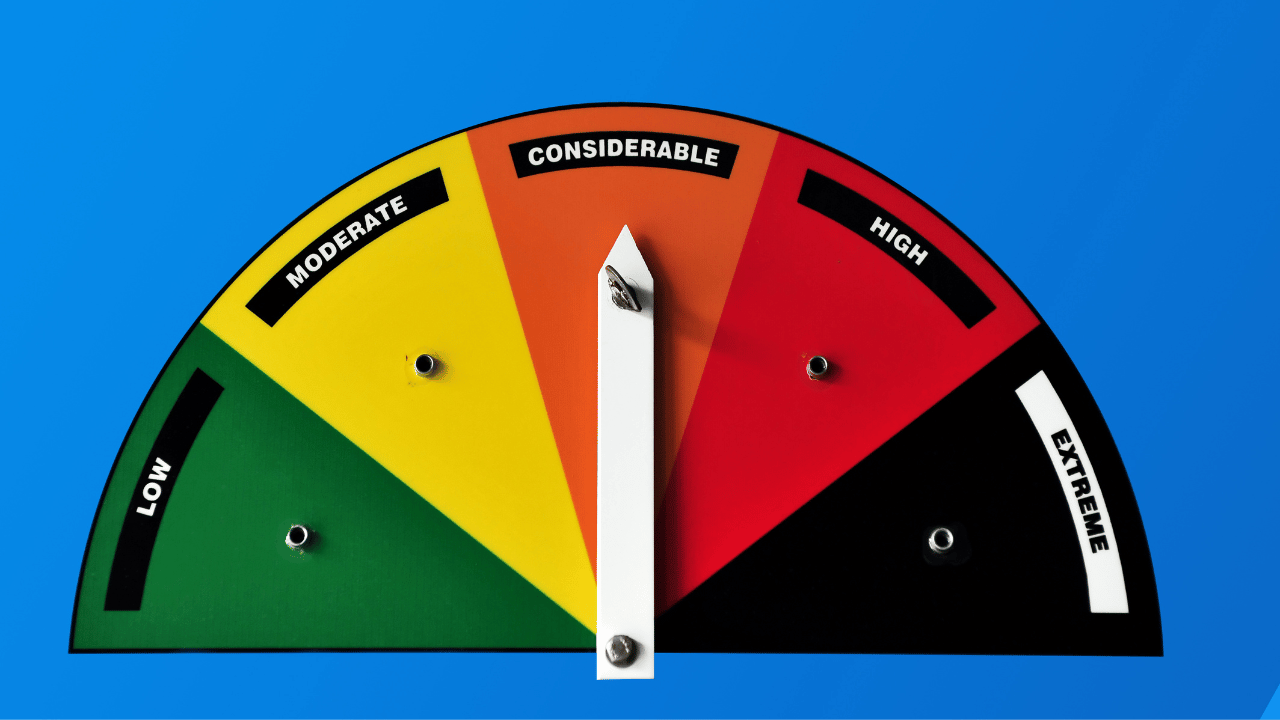

Lender's Perspective on Credit Scores :

Gain insights into the risk assessment undertaken by lenders when evaluating credit scores for working capital loans. Understand how lenders weigh the risk-reward ratio, determining the interest rates that align with the perceived creditworthiness of borrowers.

Navigating Interest Rate Variances for Working Capital :

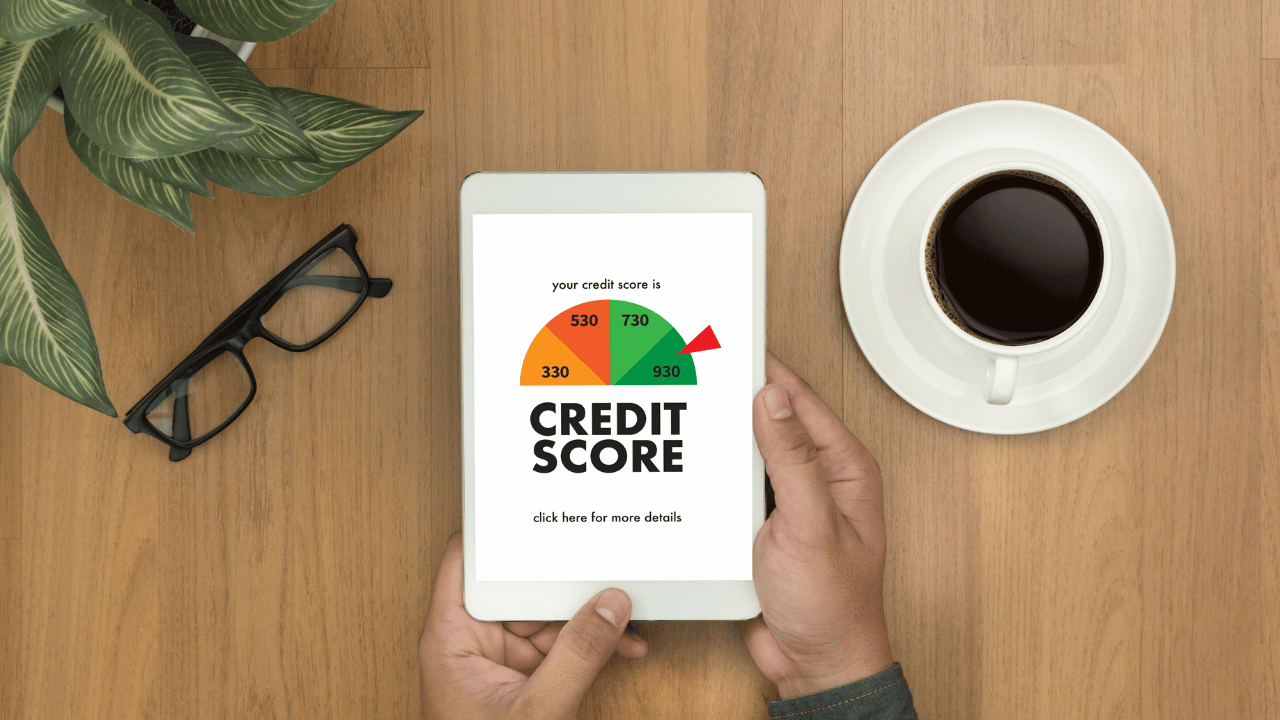

Explore the different credit score tiers and their corresponding implications on interest rates. From excellent to poor credit, decipher how each tier influences the cost of obtaining working capital, providing borrowers with a roadmap for financial planning.

Leveraging Your Credit Score for Favorable Rates :

Equip yourself with negotiation tactics to leverage your credit score for more favorable working capital loan rates. Discover strategies to strengthen your bargaining position and secure optimal terms that align with your financial goals.

How Regulations Influence Working Capital Loan Terms :

Understand the regulatory framework that governs working capital loans and its impact on interest rates. Explore how compliance and legal considerations contribute to the formulation of terms, ensuring a comprehensive understanding of the financial landscape.

Factors Influencing Working Capital Rates :

Uncover the additional factors that can influence working capital loan rates beyond credit scores. From business financials to market conditions, grasp the holistic view that lenders consider when determining the cost of providing working capital.

Credit Score Dynamics and Loan Rates :

Conclude the exploration by delving into future trends, anticipating how credit score dynamics and working capital loan rates may evolve. Stay ahead of the curve and prepare for the changing landscape of financial borrowing.

Conclusion :

Navigate the intricate relationship between credit scores and working capital loan rates with our comprehensive guide. Explore credit score tiers, negotiation tactics, and regulatory influence rates for working. Your path to optimal working capital terms begins here.