Navigating the US Credit System

Embarking on a journey as an international student in the US comes with the need to understand and navigate the intricacies of the credit system. In this section, we explore the fundamental aspects that make up the credit landscape

considerations for international students.

Setting Financial Goals for the Future :

Wrap up the guide by discussing the significance of long-term financial planning. International students will gain insights into setting achievable financial goals and building a strong credit foundation for their future endeavors.

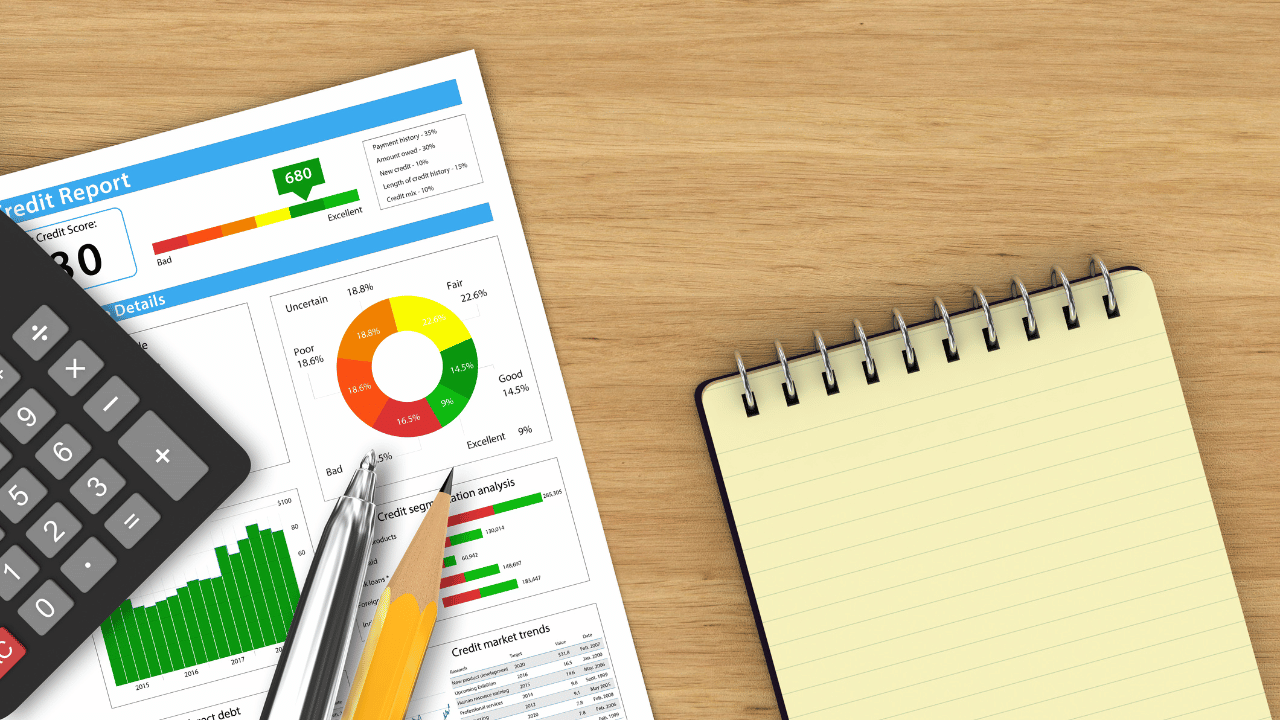

Establishing a Financial Identity :

Dive into the significance of establishing a financial identity through credit scores. We’ll discuss how international students can start building credit and the factors that influence their credit scores.

Special Considerations :

Explore the unique challenges that international students may encounter when it comes to building and managing credit in a new country. From limited credit history to unfamiliar financial system.

Securing Credit :

Uncover the various credit options available for international students, including secured credit cards, co-signers, and other strategies to kickstart their credit journey in the US.

Navigating the Application Process :

Learn about the dos and don’ts of the credit application process for international students. From choosing the right credit card to understanding the implications of credit inquiries.

Responsible Credit Practices :

Discover the importance of adopting responsible credit practices. We’ll delve into the habits that contribute to a positive credit history, fostering financial responsibility and stability for international students.

Monitoring and Managing Credit :

Explore the tools and resources available for international students to monitor and manage their credit effectively. From credit monitoring services to budgeting apps.

Conclusion :

Embark on a financial journey as an international student in the US with our comprehensive guide on credit score considerations for international students. From establishing credit to overcoming challenges, this resource provides valuable insights and practical tips for international students navigating the US credit landscape.