Understanding Copier Leasing

Explore the intricacies of copier leasing and how businesses can benefit from this cost-effective option. Learn about the flexibility and features associated with credit impact of copier leasing for enhanced office efficiency.

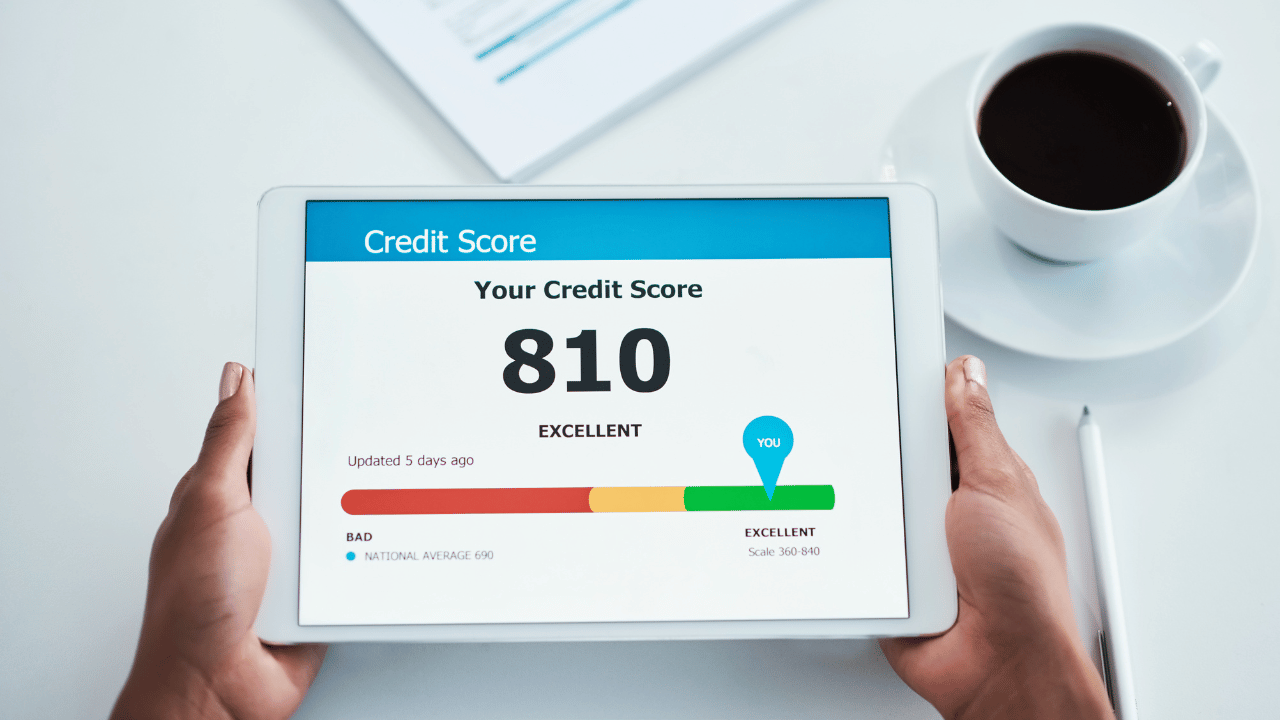

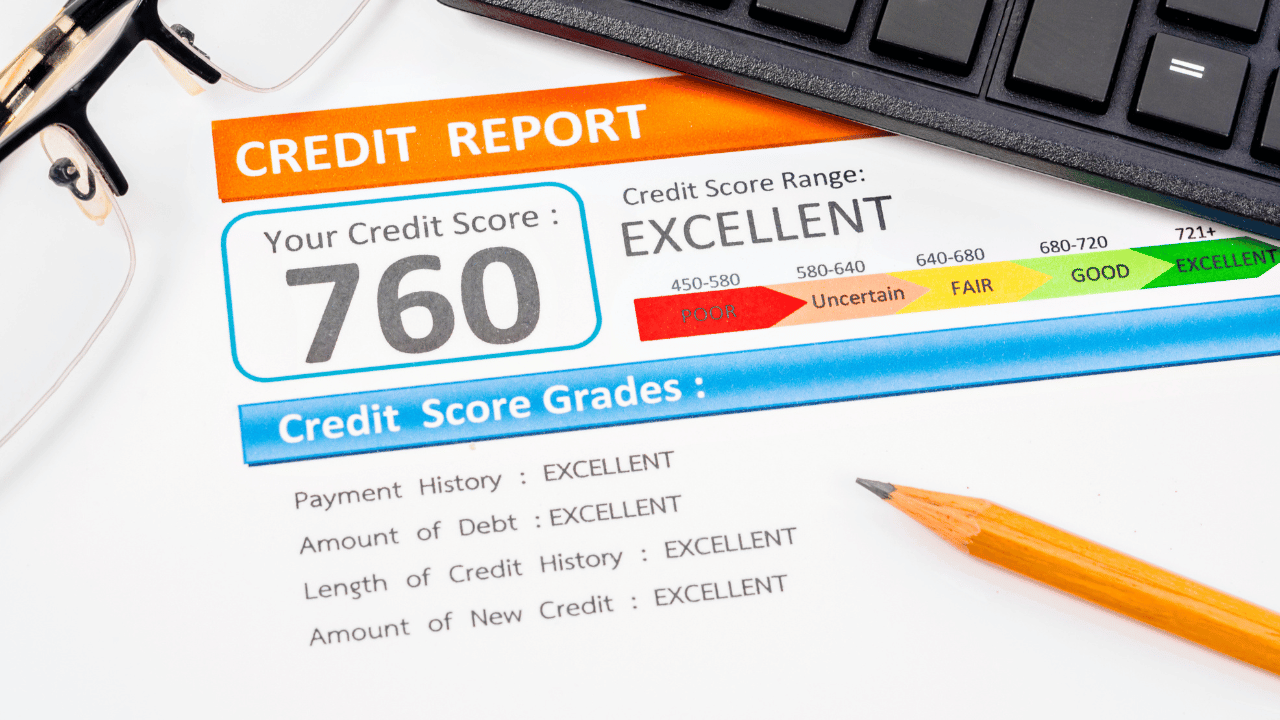

Financial Implications of Copier Leasing :

Dive into the credit impact of choosing copier leasing for your business. Uncover how this decision can influence your credit profile and financial standing, providing valuable insights for businesses considering this option.

Comparing Copier Leasing to Purchasing :

Analyze the pros and cons of copier leasing versus outright purchasing. Understand how each option affects your bottom line and creditworthiness, helping you make an informed decision based on your business needs.

Lease Terms and Credit Considerations :

Delve into the various lease terms available for copiers and their implications on credit. Explore how lease durations and terms can impact your credit standing and financial stability, providing a comprehensive view of the credit landscape.

Navigating Credit Approval for Copier Leasing :

Understand the credit approval process associated with copier leasing. Discover tips and strategies to enhance your chances of securing a copier lease, ensuring your business benefits from the latest technology without compromising credit health.

Copier Leasing Industry Trends :

Stay updated on the latest trends in the copier leasing industry. Explore how technological advancements and changing market dynamics can influence your credit decisions when opting for copier leasing solutions.

Realizing Cost Savings Through Copier Leasing :

Examine the potential cost savings achievable through copier leasing arrangements. Understand how this approach can positively impact your business’s financial outlook and creditworthiness in the long run.

Credit Repair Strategies Post Copier Leasing :

In the final section, discover effective credit repair strategies post-copier leasing. Learn how businesses can strategically manage credit implications and work towards improving credit scores after entering into a copier leasing agreement.

Conclusion :

Explore the world of copier leasing and its credit implications in this insightful blog. From understanding financial considerations to navigating credit approvals, this guide provides a comprehensive view of the keyword credit impact of copier leasing. Gain valuable insights into industry trends and make informed decisions for your business’s financial health.