A Guide on How to Invest in Peer-to-Peer Lending

Embark on a financial journey as we explore the lucrative landscape of how to invest in peer-to-peer lending. This comprehensive guide provides insights into the dynamics of P2P lending and equips you with the knowledge needed to navigate this alternative investment avenue.

Understanding Peer-to-Peer Lending :

Delve into the fundamentals of peer-to-peer lending, deciphering how this decentralized lending model connects borrowers directly with individual lenders. Explore the principles that underpin this financial frontier.

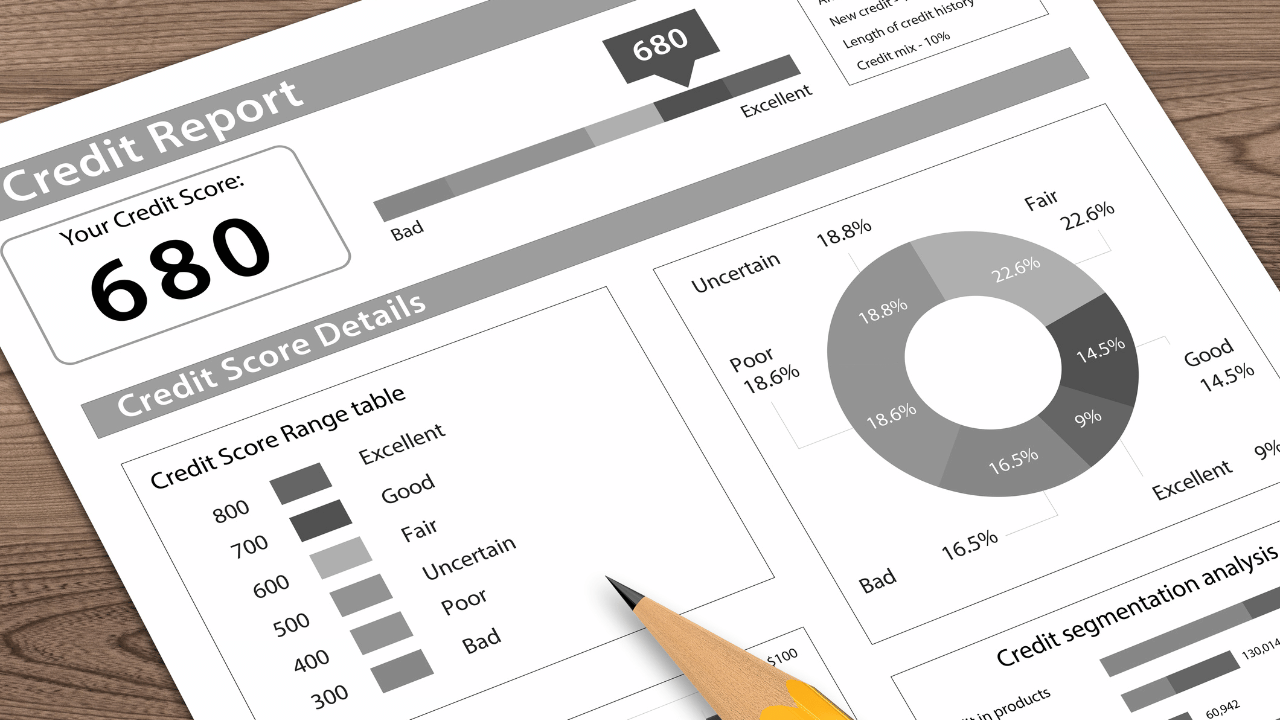

Assessing Risk and Returns :

Navigate the intricacies of risk and return in P2P lending. Understand how to evaluate borrower profiles, loan terms, and other factors to make informed investment decisions while maximizing your potential returns.

Choosing the Right P2P Platform :

Explore the diverse landscape of P2P lending platforms. Learn to distinguish between various platforms, considering factors such as reputation, track record, and the types of loans offered.

Diversification Strategies :

Uncover the importance of diversification in P2P lending portfolios. Explore strategies to spread your investments across multiple loans, minimizing risk and enhancing the stability of your investment portfolio.

Staying Informed About Regulatory Landscape :

Stay abreast of the regulatory environment surrounding P2P lending. Explore the evolving landscape of regulations and compliance to make informed investment decisions within legal parameters.

Maximizing Returns Through Automation :

Discover the benefits of automation tools in P2P lending. Learn how automated investment platforms can streamline your investment process, saving time and potentially enhancing your returns.

Conclusion :

Embark on a financial expedition with our guide on how to invest in peer-to-peer lending. From understanding the fundamentals to assessing risk, choosing the right platform, and maximizing returns, this comprehensive resource equips you for success in the dynamic world of P2P lending.